Wills, Executors & Probate

Summary

Wills and probate in NSW follow strict rules on what a will covers, how it must be signed and witnessed, who can access it, and when marriage, divorce, or alterations change it. Courts can accept informal wills and fix drafting errors. Executors apply for probate, then collect, pay, and distribute assets.

Table of Contents

- Introduction

- Definition and Scope of a Will

- Legal Requirements for Executing a Will

- Role and Eligibility of Witnesses

- Capacity and Age Requirements

- Revocation and Alteration

- Court Powers of Rectification

- Storage and Access of Wills

- Executor’s Responsibilities

- What Is Probate and How to Apply?

- Conclusion

- FAQs

- Inheritance & Estate Planning Knowledge Bundle

Introduction

The Succession Act 2006 (NSW) sets clear rules on what a will covers, how it must be signed, who can witness it, and when the Court can step in. This guide explains capacity, revocation and alterations, rectification, how wills can be stored and accessed, what executors must do, and how probate works through the Supreme Court.

Use it to understand the process, spot gaps in your documents, and ask better questions of your solicitor and adviser.

Definition and Scope of a Will

Section 3 of the Succession Act 2006 (NSW) says a “will includes a codicil and any other testamentary disposition”. The Act also defines “disposition” to include “any gift, devise or bequest of property under a will”, “the creation by will of a power of appointment affecting property”, and “the exercise by will of a power of appointment affecting property”.

A will can cover more than what you own at the time you sign it. Section 4 allows you to dispose of “property to which the person is entitled at the time of the person’s death”, even if “the entitlement existed” only after the will was made. It also covers property your “personal representative becomes entitled … after the person’s death”.

If you sell part of an asset after making your will, Section 29 says “the will operates to dispose of any remaining interest the testator has in the property.”

The Court can also accept an informal document as a will if it “purports to state the testamentary intentions of a deceased person” and the Court is satisfied the person “intended it to form his or her will.”

Finally, Section 4 states you “may not dispose by will of property of which the person is trustee at the time of the person’s death.”

Legal Requirements for Executing a Will

Section 6 of the Succession Act 2006 (NSW) sets the basic signing rules. It says a will is not valid unless “it is in writing and signed by the testator or by some other person in the presence of and at the direction of the testator”.

It also requires the signature to be “made or acknowledged by the testator in the presence of 2 or more witnesses present at the same time”.

Finally, “at least 2 of those witnesses” must “attest and sign the will in the presence of the testator (but not necessarily in the presence of each other)”.

Section 6(2) adds that the signature “must be made with the intention of executing the will”, and “it is not essential that the signature be at the foot of the will”.

Role and Eligibility of Witnesses

In NSW, a witness must be able to see the testator sign. Section 9 states: “A person who is unable to see and attest that a testator has signed a document may not act as a witness to a will.”

A will is signed in front of witnesses. Section 6 requires the signature to be “made or acknowledged by the testator in the presence of 2 or more witnesses present at the same time”, and at least two witnesses must “attest and sign the will in the presence of the testator (but not necessarily in the presence of each other).”

Witnesses are confirming the signing process, not assessing the content. Section 7 says a will is validly executed even if a witness “did not know that the document he or she attested and signed was a will.”

If changes are made after signing, Section 14 allows the alteration to be signed “in the margin, or on some other part of the will beside, near or otherwise relating to the alteration.”

A witness who receives a gift may lose it. Section 10 says the gift is “void to the extent that it concerns the interested witness”, unless an exception applies. It also confirms “reasonable remuneration to an executor, administrator, legal practitioner” is not treated as a gift.

Capacity and Age Requirements

According to Section 5, “A will made by a minor is not valid.” There are limited exceptions. A minor can make a will “in contemplation of marriage”, but “the will is of no effect if the marriage contemplated does not take place”. A minor “who is married” can make, alter, or revoke a will, and a minor “who has been married” can revoke a will made while married or in contemplation of that marriage.

If those exceptions do not apply, under Section 16, the Supreme Court can authorise a minor “to make or alter a will in the specific terms approved by the Court” (or revoke one). Before it does, the Court must be satisfied the minor understands the proposed will and its effect, that it reflects the minor’s intentions, and that it is reasonable.

For a person who lacks testamentary capacity, the Court can authorise a will to be made, altered, or revoked. You need the Court’s leave, and the Court applies specific tests before allowing the application.

As per Section 23, a will made under a capacity order is executed if it is in writing and “signed by the Registrar and sealed with the seal of the Court.”

Revocation and Alteration

A will (or part of it) can be revoked in specific ways. Section 11 says this includes revocation “by a later will”, or “by some writing declaring an intention to revoke it” that is executed like a will. It also allows revocation by “burning, tearing or otherwise destroying the will with the intention of revoking it”, or by marking or dealing with the will so the Court is satisfied, from the “state of the will”, that revocation was intended.

Marriage can revoke a will, with exceptions (for example, a will made “in contemplation of a particular marriage”) (Section 12). Divorce or annulment revokes gifts and appointments to a former spouse, including an appointment as “executor, trustee … or guardian”, unless the will shows a contrary intention (Section 13).

For changes after signing, Section 14 says an alteration is not effective unless it is “executed in the manner in which a will is required to be executed.”

Court Powers of Rectification

When wills contain drafting mistakes, Section 27(1) lets the Court “make an order to rectify a will to carry out the intentions of the testator” if it is satisfied the will fails because “a clerical error was made” or “the will does not give effect to the testator’s instructions.” An application must be made “within 12 months after the date of the death of the testator”, although the Court can extend time if it “considers it necessary” and “the final distribution of the estate has not been made.”

Section 28 protects executors and administrators who distribute before a rectification order is made. A personal representative is not liable if the distribution was made under Section 92A of the Probate and Administration Act 1898 (maintenance distributions within 30 days), or if it was made “at least 6 months after the date of the death” and the personal representative was “not aware of an application” under Section 27 (or Chapter 3) and complied with Section 92 notice requirements.

Free eBook: Executor Starter Pack – Probate Timeline + Task Checklist (Instant Download)

〰️

Free eBook: Executor Starter Pack – Probate Timeline + Task Checklist (Instant Download) 〰️

Storage and Access of Wills

NSW law lets you store a will with the Court so it can be found later. Section 51 says “Any person may deposit a will in the office of the Registrar.” To be accepted, it must be “in a sealed envelope” with key details written on it, including “the testator’s name and address”, “the name and address … of any executor”, “the date of the will”, and “the name of the person depositing the will.”

A fee normally applies, but “a fee is not payable” in limited situations, including where the will is deposited under a court-authorised will process (Sections 16 or 18), or because a local legal practitioner has died or ceased practice. Wills authorised by the Court for minors or people who lack testamentary capacity “must be deposited with the Registrar under Part 2.5.”

During life, the testator can request the Registrar return the will, but the Registrar must not return it if the testator “is a minor” or “lacks testamentary capacity.”

After death, Section 54 requires a person who has the will to allow certain people to “inspect or be given copies of the will (at their own expense)”, including a spouse or de facto partner, children, and people named in the will.

Executor’s Responsibilities

In the Succession Act 2006 (NSW), an executor is a type of “personal representative”, which the Act defines as “the executor or administrator of the estate of a deceased person.”

If the will was deposited with the Registrar, Section 52 says that after death “any executor named in the will … may apply in writing to the Registrar to be given the will.”

Once the executor has authority to act, their work centres on collecting estate assets, dealing with debts and expenses, and then distributing the estate as the will directs. Where a gift is made to an unincorporated association, Section 43 says the treasurer’s receipt “is an absolute discharge for the payment.”

If a witness is also an executor, the Act clarifies that “reasonable remuneration to an executor” is not treated as a gift under the “interested witness” rule.

After divorce, Section 13 confirms a former spouse can still act as trustee in limited cases, including where they are appointed “as trustee of property left by the will on trust for beneficiaries that include the former spouse’s children.”

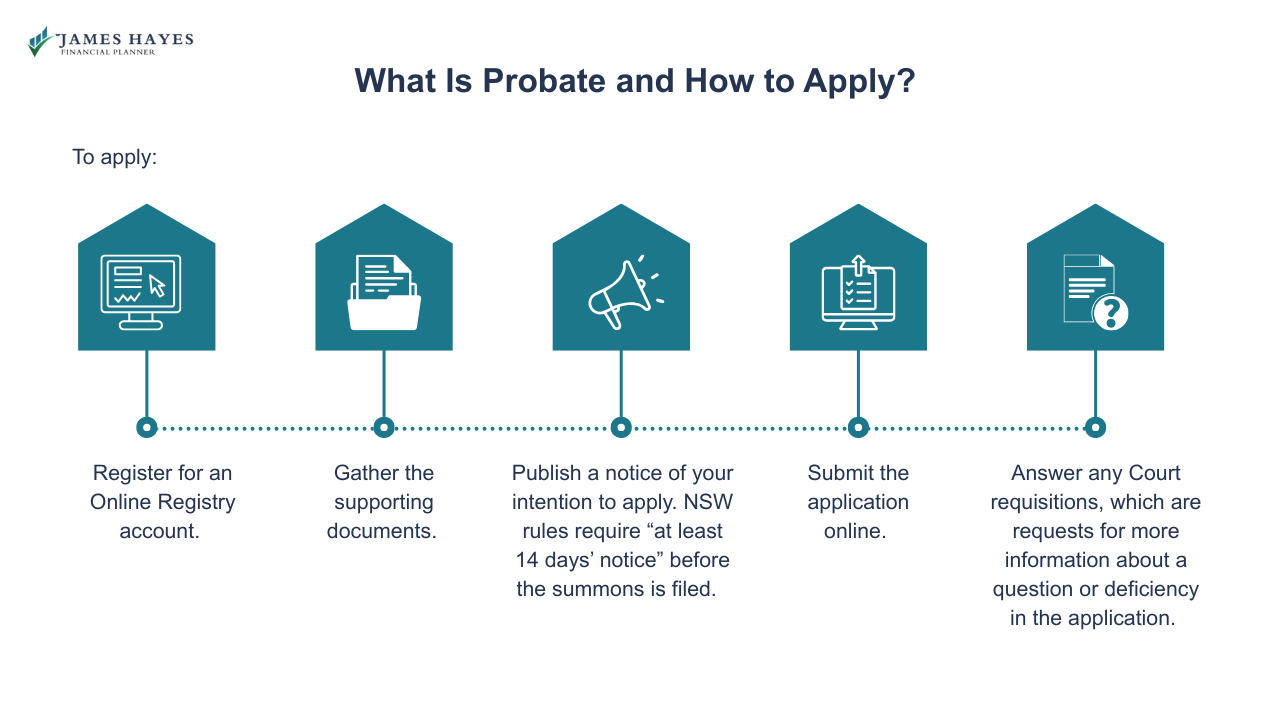

What Is Probate and How to Apply?

An executor applies for probate. Probate is a Supreme Court of NSW order, which, when granted, confirms that the “Will is valid” and the “Executor has permission to distribute the estate according to the Will.” “Probate” is also the NSW Online Registry service used for uncontested applications.

To apply:

Register for an Online Registry account.

Gather the supporting documents.

Publish a notice of your intention to apply. NSW rules require “at least 14 days’ notice” before the summons is filed.

Submit the application online.

Answer any Court requisitions, which are requests for more information about a question or deficiency in the application.

Conclusion

A will only works when it is current, correctly executed, and easy to locate. Probate, executor duties, and Court powers can affect timing, costs, and how assets are distributed. If your estate includes property, business interests, blended family arrangements, or beneficiaries overseas, small drafting or signing errors can create delays.

James Hayes can help you map your assets, check your cash flow plan for your beneficiaries, and coordinate with your solicitor and accountant so the financial side matches the legal documents. Book a no-obligation 15-minute consultation to discuss next steps. Appointments are available in the Sutherland Shire and Sydney CBD.

FAQs

-

A will must meet the signing rules in Section 6 of the Succession Act 2006 (NSW): it must be in writing, signed by the testator (or at their direction), and the signature must be made or acknowledged in front of two witnesses present at the same time. Courts can accept informal documents, but it is safer to execute properly.

-

A beneficiary can witness a will, but it can create problems. Under Section 10, a gift to an “interested witness” can be void to the extent it benefits that witness (or someone claiming under them), unless an exception applies. If a witness might receive a gift, get legal advice before signing.

-

Start by checking likely storage points: the deceased’s solicitor, a safe, a bank safe custody packet (if used), or deposit with the Registrar under Section 51. If someone has possession or control of the will, Section 54 can require them to allow eligible people to inspect it or receive copies.

-

Yes. Section 12 provides that marriage revokes a will, with exceptions such as a will made in contemplation of a particular marriage and certain gifts to the spouse. Section 13 states divorce or annulment revokes gifts and appointments to a former spouse, unless the will shows a contrary intention. Review documents after relationship changes.

-

Section 11 allows revocation by a later will, a written revocation executed like a will, or by destroying the will with intent to revoke. If you want to change only part of a will, Section 14 sets rules for alterations, including signing near the change. In most cases, a new will is clearer.

-

Probate is a Supreme Court order that confirms the will is valid and gives the executor authority to deal with the estate. Applications are lodged through the NSW Online Registry. A notice period applies before filing, and the Court may issue requisitions asking for more information. Timing depends on complexity, assets, and disputes.

Inheritance & Estate Planning Knowledge Bundle

- Inheritance & Estate Planning Explained

- Understanding Inheritance Tax in Australia

- Superannuation Death Benefits

- Tax Implications for Beneficiaries

- Gifting vs Inheriting

- Blended Families & Estate Disputes

- Deceased Estates & Capital Gains

- Financial Planning After Inheritance

- Ethical Will & Legacy Planning

Disclaimer

The information in this article is provided as a general guide only. It does not constitute personal financial advice and should not be relied upon as such. Readers should seek advice from a licensed financial adviser before making any financial decisions. James Hayes and his associated entities accept no responsibility or liability for any loss, damage, or action taken in reliance on the information contained in this article. Links to third-party websites are provided for reference purposes only. We do not endorse or guarantee the accuracy of their content.