Gifting vs Inheriting in Australia

Summary

Gifting transfers assets during your lifetime, usually with immediate loss of control and potential CGT, and in NSW, possible transfer duty on property. Inheriting transfers assets after death via a will or intestacy, with estate administration steps and different tax timing. The right option depends on control, timing, tax, and eligibility rules.

Table of Contents

- Introduction

- What Is Gifting?

- What Is Inheriting?

- Differences Between Gifting and Inheriting

- Gifting Tax and Duty Considerations

- Inheritance Tax and Duty Considerations

- Non-Tax Factors That Decide the Outcome

- When Is Gifting Better Than Inheriting?

- When Is Inheriting Better Than Gifting?

- Checklist Before Choosing Gifting or Inheriting

- Conclusion

- FAQs

- Inheritance & Estate Planning Knowledge Bundle

Introduction

For wealth builders (35–50) and pre-retirees and retirees (55–65) in the Sutherland Shire and Sydney CBD, “helping the kids now” and “leaving it in the will” incite different tax outcomes, legal steps, and control issues. Australia has no gift tax and no inheritance tax, but both paths can still trigger CGT, transfer duty (NSW property), superannuation tax outcomes, and means-testing consequences.

This article compares gifting and inheriting for you.

What Is Gifting?

A gift is a transfer of ownership you make while alive. A gift can include cash, transferring shares, transferring an investment property, forgiving a loan, or adding someone to an asset title in a way that changes beneficial ownership. If ownership changes, tax and duty rules can apply even if no money changes hands.

What Is Inheriting?

Inheritance occurs after death. Assets pass through the estate under a will (or intestacy laws in the Succession Act 2006) and are administered by an executor or administrator. Some assets, especially superannuation death benefits, can be paid outside the estate depending on fund rules and trustee decisions.

Differences Between Gifting and Inheriting

Timing, control, and administration distinguish a gift from an inheritance. The right term depends on these factors:

Control: Gifts are irreversible once title transfers. Inheritance keeps control until death.

Timing: Gifts can fund deposits, education, or business needs now. Inheritance is later and can be delayed by administration.

Tax friction: Gifts can trigger CGT immediately. Inheritance often shifts tax to a later sale or distribution event.

State duties: NSW property transfers can attract transfer duty based on value even for $0 consideration.

Eligibility impacts: Age Pension gifting limits can treat excess gifts as “deprived assets” for five years.

Documentation and fairness: Lifetime gifts can create uneven outcomes unless documented and reflected in the estate plan.

Gifting Tax and Duty Considerations

Australia does not impose a gift tax, but other rules can apply.

CGT When You Gift CGT Assets

If you gift a CGT asset (for example, shares, or an investment property), the transfer is a disposal. CGT event A1 happens when ownership changes. Where parties are not dealing at arm’s length or proceeds are not market value, the market value substitution rule can treat the proceeds as market value under Section 116-30 of the Income Tax Assessment Act 1997.

NSW Transfer Duty on Gifted Property

If you gift NSW real property, transfer duty can still apply. Under Section 21 of the Duties Act 1997 (NSW), dutiable value is generally the greater of consideration and unencumbered value, which is why $0 transfers can still be assessed on value. There are specific exemptions and concessions for certain transfers, including some transfers between spouses or de facto partners, subject to conditions.

Donations to Deductible Gift Recipients

Charitable gifts are a separate category. The ATO allows deductions for gifts or donations to deductible gift recipients (DGRs) where conditions are met, including that it is a genuine gift and you receive no material benefit, and it is generally $2 or more. This is different from gifting to family, which is generally not deductible.

Inheritance Tax and Duty Considerations

Australia does not tax beneficiaries simply for receiving an inheritance, but tax can arise later (income on inherited assets, and CGT on a later sale).

Superannuation is the exception where tax can be immediate. A person is a “death benefits dependant” under Section 302-195 of the Income Tax Assessment Act 1997 if they meet the statutory definition (spouse or former spouse, child under 18, interdependency relationship, or other dependant).

Where a super death benefit lump sum is paid to a non-dependant, the taxable component can be assessable and taxed under Section 302-145.

Free eBook: Gift vs inherit Decision Matrix

〰️

Free eBook: Gift vs inherit Decision Matrix 〰️

Non-Tax Factors That Decide the Outcome

Tax matters, but it is rarely the only deciding factor.

Age Pension Gifting Limits for Retirees

For clients close to retirement or already retired, gifting can affect entitlements. Services Australia’s Age Pension gifting rules state a person can generally gift $10,000 per financial year and $30,000 over five financial years (with no more than $10,000 in a single financial year) before the excess is assessed as a deprived asset. Excess gifts can be counted under the assets test and deemed under the income test for five years.

Irrevocability and Asset Protection

Once you transfer legal ownership, recovery usually depends on the recipient’s consent or litigation. Gifting also changes who the asset belongs to for creditor and relationship property risks. If asset protection is a priority, legal structuring advice is usually required before transfer.

Overseas Transfers and Foreign Structures

If you receive payments or assets from a foreign trust, the ATO in Section 99B of the Income Tax Assessment Act 1936 can include amounts in assessable income, subject to exclusions and documentation. Separately, AUSTRAC requires reporting entities to report cash transactions of $10,000 or more (the reporting obligation sits with the reporting entity).

If you are dealing with property and foreign residency, the ATO notes that special rules can deny access to the main residence exemption for foreign residents, and those rules can also affect deceased estates and beneficiaries in certain cases.

When Is Gifting Better Than Inheriting?

Gifting is most used when timing is the dominant priority and the giver’s long-term cash flow is already secured.

Common use cases include funding a home deposit, paying for education costs, or simplifying an estate by transferring non-core assets earlier, while accepting that CGT and duty may apply upfront. Where fairness across beneficiaries matters, documentation usually needs to track gifts made.

When Is Inheriting Better Than Gifting?

Inheritance tends to suit situations where retaining control and flexibility is the priority.

Common use cases include holding the family home, retaining investment assets for retirement funding, or where beneficiaries’ circumstances may change (relationship status, residency, business risk), and you want the estate plan to stay adjustable. Inheritance also keeps asset transfers aligned with formal will execution and estate administration processes.

Checklist Before Choosing Gifting or Inheriting

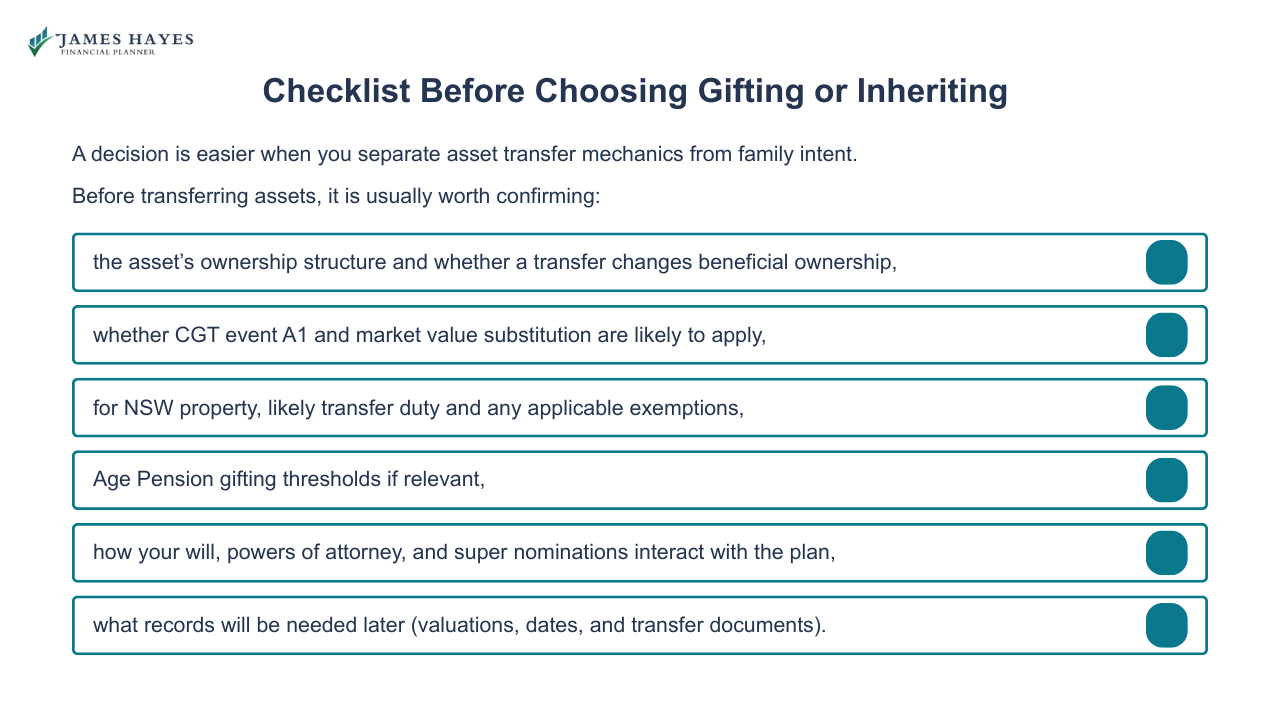

A decision is easier when you separate asset transfer mechanics from family intent.

Before transferring assets, it is usually worth confirming:

the asset’s ownership structure and whether a transfer changes beneficial ownership,

whether CGT event A1 and market value substitution are likely to apply,

for NSW property, likely transfer duty and any applicable exemptions,

Age Pension gifting thresholds if relevant,

how your will, powers of attorney, and super nominations interact with the plan,

what records will be needed later (valuations, dates, and transfer documents).

Conclusion

Gifting and inheriting solve different problems. Gifting prioritises timing and can trigger immediate CGT and, in NSW, transfer duty on property transfers. Inheriting preserves control but relies on estate administration and can shift tax to future events, with superannuation rules being a frequent exception.

James Hayes is an ASIC-licensed financial adviser based in Caringbah, working with wealth builders and pre-retirees and retirees across the Sutherland Shire and Greater Sydney, with availability for Sydney CBD meetings. He can model the financial trade-offs of gifting versus retaining assets, then coordinate with your solicitor and tax agent on implementation.

FAQs

-

The treatment is not automatic. If you want a lifetime gift to reduce a later inheritance, document it, keep supporting records (date, amount, purpose), and ensure your estate plan reflects the intended adjustment. Without documentation, executors follow the will wording, not informal family expectations.

-

A gift can trigger CGT event A1 when ownership changes. If the transfer is not at arm’s length or has $0 consideration, the market value substitution rule may apply, treating proceeds as market value for CGT calculations under Section 116-30 of the Income Tax Assessment Act 1997.

-

NSW transfer duty is assessed on the dutiable value, which is commonly the greater consideration and the property’s unencumbered value. This means $0 transfers can still attract duty. Some exemptions exist, including certain spouse or de facto transfers, subject to conditions.

-

Services Australia states you can gift $10,000 per financial year and $30,000 over five financial years (with no more than $10,000 in a single year) before the excess is treated as a deprived asset. Excess amounts can be assessed for five years under the tests.

-

No. Superannuation death benefits can be taxed based on the recipient’s status. “Death benefits dependant” is defined in Section 302-195 of the Income Tax Assessment Act 1997. Where a lump sum is paid to a non-dependant, the taxable component can be assessable and taxed under Section 302-145.

-

Not always. Large cash transfers of $10,000 or more must be reported to AUSTRAC by your bank. If funds originate from a foreign trust, the ATO may treat them as taxable income under Section 99B of the Income Tax Assessment Act 1936. To ensure these payments remain tax-free, you must provide documentation proving they are non-assessable.

Inheritance & Estate Planning Knowledge Bundle

- Inheritance & Estate Planning Explained

- Understanding Inheritance Tax in Australia

- Superannuation Death Benefits

- Tax Implications for Beneficiaries

- Wills, Executors & Probate

- Blended Families & Estate Disputes

- Deceased Estates & Capital Gains

- Financial Planning After Inheritance

- Ethical Will & Legacy Planning

Disclaimer

The information in this article is provided as a general guide only. It does not constitute personal financial advice and should not be relied upon as such. Readers should seek advice from a licensed financial adviser before making any financial decisions. James Hayes and his associated entities accept no responsibility or liability for any loss, damage, or action taken in reliance on the information contained in this article. Links to third-party websites are provided for reference purposes only. We do not endorse or guarantee the accuracy of their content.