Blended Families & Estate Disputes

Summary

Blended families can trigger estate disputes in NSW when wills, super nominations, and ownership structures do not match current relationships. Learn who can claim, how marriage or divorce changes wills, how notional estate can pull back assets, what courts consider, and the deadlines that apply before distributions begin after death.

Table of Contents

- Introduction

- Who Are Eligible Persons in Blended Families?

- Marriage, Divorce, and Annulment

- Superannuation Death Benefits and Nominations

- Dependants Under Superannuation vs. Tax Law

- What Is Adequate Provision?

- What Is Notional Estate?

- Factors the Court Considers in Disputes

- Statutory Wills for Those Lacking Capacity

- Maintenance Distributions for Survivors

- Child Recipients and Income Streams

- Time Limits for Legal Challenges

- Release of Rights to Claim

- Conclusion

- FAQs

Introduction

Blended families can create estate outcomes that surprise people, even when there is a will. Competing expectations often exist across current partners, former spouses, biological children, and step-children.

In NSW, the laws around family provision, notional estate, superannuation death benefits, nominations, and time limits shape what can be challenged, who can apply, and how quickly decisions need to be made.

This guide explains who may be eligible, how marriage and divorce affect wills, how super can be paid outside the estate, what the Court considers, and where deadlines apply.

Who Are Eligible Persons in Blended Families?

Estate disputes in blended families often start with a family provision claim. The Succession Act 2006 (NSW) lists who can apply as an “eligible person”:

Spouse at the date of death

De facto partner living with the deceased at the date of death

Child of the deceased

Former spouse

Person who was wholly or partly dependent on the deceased and was either a grandchild, or a member of the same household

Person in a “close personal relationship” with the deceased at the date of death

For superannuation, eligibility and tax treatment are separate issues. Super law uses a “dependant” definition that includes:

Spouse

Child

Interdependency relationship

Tax law uses “death benefits dependant”, which includes:

Spouse or former spouse

Child under 18

Interdependency relationship

Another dependant

Marriage, Divorce, and Annulment

In NSW, relationship status can change how a will operates, without anyone rewriting the document.

Marriage (Section 12)

Marriage “revokes” a will. A will is not revoked if it was made “in contemplation of a particular marriage” or “in contemplation of marriage generally.” Some parts can also survive, including “a disposition” to the spouse and their appointment as “executor, trustee, advisory trustee or guardian.”

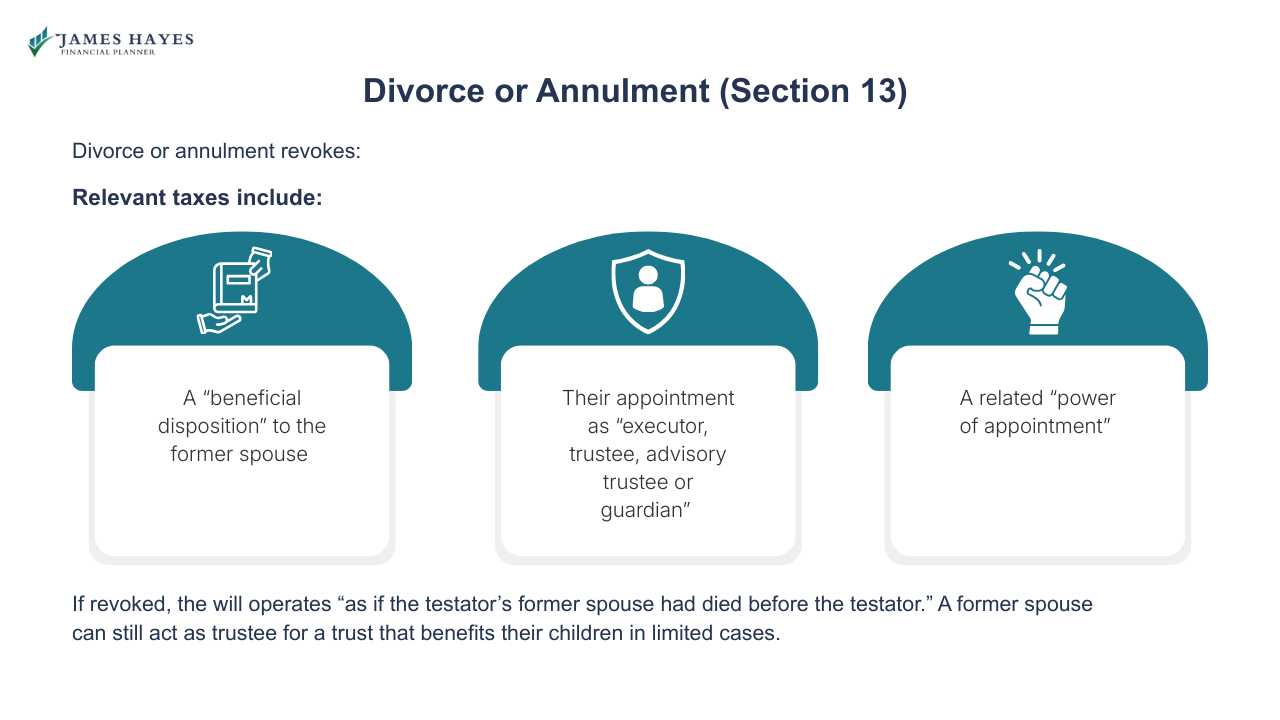

Divorce or Annulment (Section 13)

Divorce or annulment revokes:

A “beneficial disposition” to the former spouse

Their appointment as “executor, trustee, advisory trustee or guardian”

A related “power of appointment”

If revoked, the will operates “as if the testator’s former spouse had died before the testator.” A former spouse can still act as trustee for a trust that benefits their children in limited cases.

Superannuation Death Benefits and Nominations

Super is held in a trust, so it is paid under the fund rules, not your will. The ATO explains you can make either a binding or non-binding nomination if your fund allows it.

Binding death benefit nomination: If it meets the legal rules and is “in effect”, the trustee “must pay” the death benefit to the person or people named in the notice, as long as each is “the legal personal representative or a dependant” and the proportions are clear.

Non-binding nomination: This records your preference, but the trustee is not required to follow it and can decide who receives the benefit.

If there is no valid binding nomination, the trustee decides whether to pay a dependant or your legal personal representative (your estate). The ATO sets out who is treated as a dependant for super death benefits, including a spouse, child, and someone in an interdependency relationship.

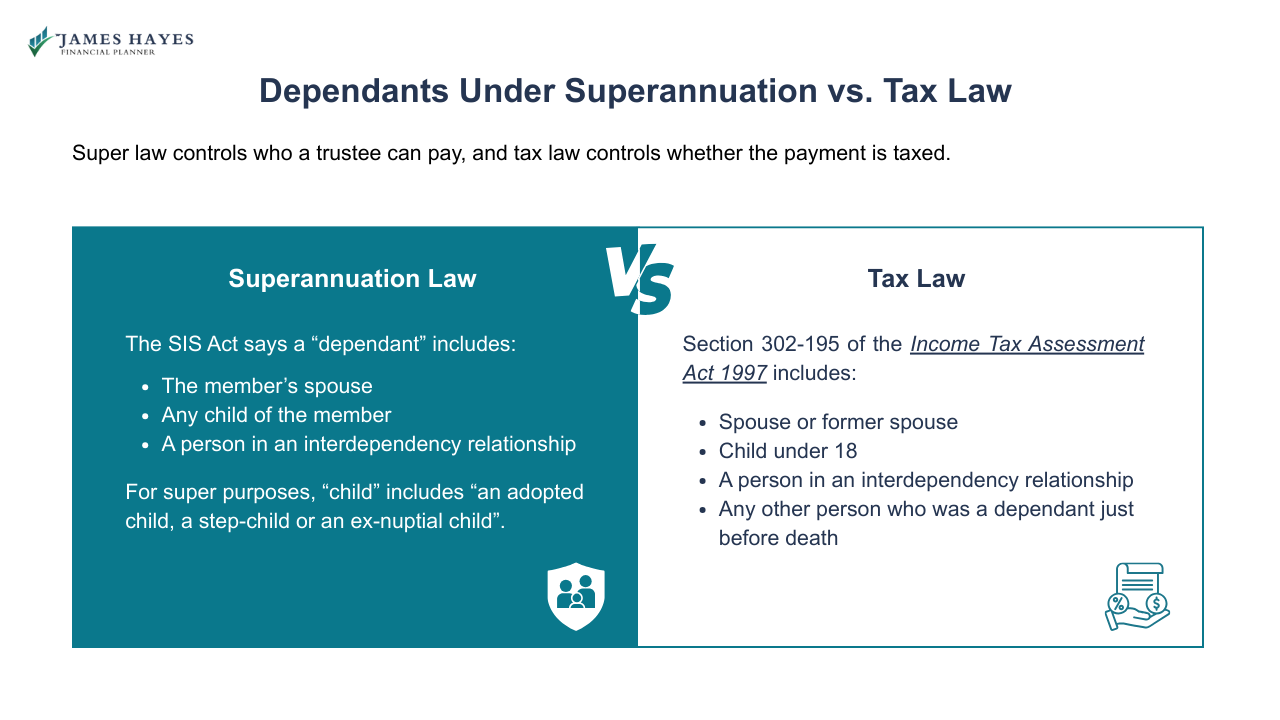

Dependants Under Superannuation vs. Tax Law

Super law controls who a trustee can pay, and tax law controls whether the payment is taxed.

Superannuation Law

The SIS Act says a “dependant” includes:

The member’s spouse

Any child of the member

A person in an interdependency relationship

For super purposes, “child” includes “an adopted child, a step-child or an ex-nuptial child”.

Tax Law

Section 302-195 of the Income Tax Assessment Act 1997 includes:

Spouse or former spouse

Child under 18

A person in an interdependency relationship

Any other person who was a dependant just before death

Interdependency Relationship

It requires a close personal relationship, living together, financial support, and domestic support and personal care. The ATO notes disability can explain why one or more conditions are not met.

Financial Dependency

The ATO says being financially dependent means you “relied on them for necessary financial support”, and children over 18 must meet this to be treated as dependants for tax.

What Is Adequate Provision?

The Court can make a family provision order under the Family Provision Act 1982 (NSW) if, when it looks at the case, “adequate provision for the proper maintenance, education or advancement in life” has not been made by the will, the intestacy rules, or both.

If that test is met, the Court can make an order “out of the estate”. The Act also allows orders that reach property treated as “notional estate” in some cases.

To decide what is “adequate”, the Court can weigh factors listed in Section 60(2), such as:

The relationship and its duration

Obligations owed by the deceased

The size of the estate and liabilities

The applicant’s financial resources and needs

Contributions to the estate or the deceased’s welfare, plus the applicant’s “character and conduct”

An application must be made within 12 months after death, unless the Court orders otherwise.

Free eBook: Blended Family Estate Dispute Risk Audit (Instant Download)

〰️

Free eBook: Blended Family Estate Dispute Risk Audit (Instant Download) 〰️

What Is Notional Estate?

Notional estate is property the Court can designate as part of a deceased person’s notional estate for a family provision claim, even when that property is not in the estate at death. The Family Provision Act 1982 (NSW) explains this power applies “in limited circumstances” where certain transactions mean property is not included in the estate.

The Court looks for a “relevant property transaction”. This includes acts (or failures to act) that result in property being “held by another person” or “subject to a trust”, where “full valuable consideration is not given”.

Common examples include:

Not severing a joint tenancy before death, so the asset passes by survivorship

Not exercising powers over life insurance arrangements

Membership of a “scheme, fund or plan” where property shifts on death (which can capture super-related outcomes)

A notional estate order can only be made for a family provision order (or related costs orders).

Factors the Court Considers in Disputes

For a family provision claim in NSW, the Court looks at whether, at the time of the hearing, “adequate provision for the proper maintenance, education or advancement in life” has been made for the applicant (Family Provision Act 1982 (NSW)).

When deciding what order (if any) to make, Section 60 lists matters the Court may consider, including:

The relationship with the deceased, including its nature and duration

The deceased’s obligations and responsibilities to the applicant and other beneficiaries

The applicant’s financial resources and needs (now and later)

Contributions to the “acquisition, conservation and improvement” of the estate, or to the deceased’s welfare, including homemaking

The applicant’s “character and conduct” before and after death

Evidence of the deceased’s testamentary intentions, including statements they made

For some applicants (like certain dependants), the Court also considers whether there are “factors which warrant the making of the application.”

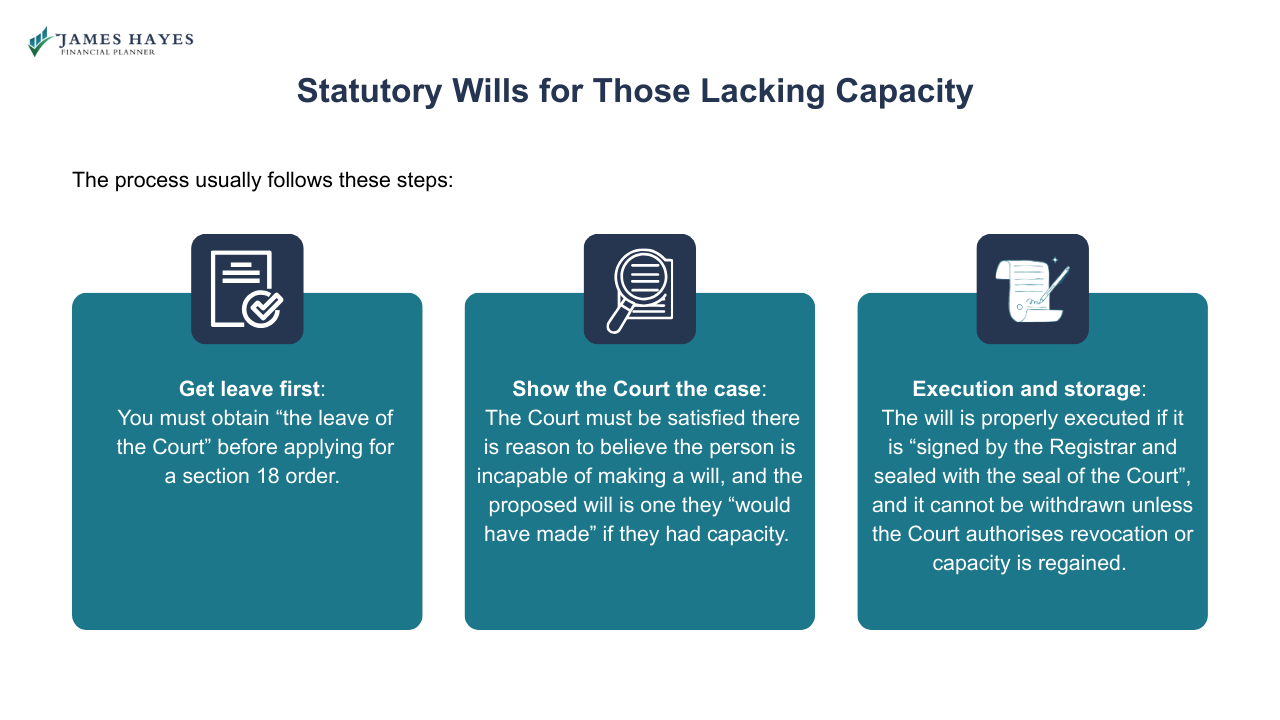

Statutory Wills for Those Lacking Capacity

If a family member cannot make a will because they lack testamentary capacity, the Supreme Court can authorise a will on their behalf. Section 18 of the Succession Act 2006 (NSW) allows the Court to approve “a will to be made or altered, in specific terms approved by the Court”, or to revoke a will.

The process usually follows these steps:

Get leave first: You must obtain “the leave of the Court” before applying for a section 18 order.

Show the Court the case: The Court must be satisfied there is reason to believe the person is incapable of making a will, and the proposed will is one they “would have made” if they had capacity.

Execution and storage: The will is properly executed if it is “signed by the Registrar and sealed with the seal of the Court”, and it cannot be withdrawn unless the Court authorises revocation or capacity is regained.

Maintenance Distributions for Survivors

NSW law lets an executor or administrator make a short-term payment to a dependant soon after death, before the estate is ready for final distribution.

Section 92A of the Probate and Administration Act 1898 applies where the survivor:

“Survives a deceased person”,

Was “wholly or substantially dependent” at the time of death, and

“Will be entitled to part or all of the … estate” if they survive for “30 days” (or another period stated in the will).

If those conditions are met, the executor “may make a distribution that is an adequate amount for the proper maintenance, support or education” “at any time after the death … including within 30 days.”

The executor can pay even if they know about “a pending … or an intended application” under the Family Provision Act 1982. If the distribution is made “in good faith”, the executor “is not liable.” The amount is deducted from the survivor’s eventual share, or treated as an “administration expense” if the survivor does not meet the survival period.

Child Recipients and Income Streams

A child can only receive a super death benefit income stream in limited cases. The ATO says it is allowed if the child is:

Under 18, or

Under 25 and financially dependent on the deceased, or

Living with a permanent disability.

Unless the child has a permanent disability, the fund must stop the income stream “on or before” the child’s 25th birthday and pay the remaining amount as a “tax-free lump sum.”

Child death benefit income streams also have special cap rules. The Income Tax Assessment Act 1997 explains a child death benefits dependant does not use their retirement transfer balance cap for the pension, but there is still a cap on how much of their death benefit income streams can receive the earnings tax exemption.

If the pension is reversionary, a transfer balance credit arises 12 months after death.

Time Limits for Legal Challenges

The Succession Act 2006 (NSW) sets clear deadlines, and missing them can limit your options.

Family Provision Claims

An application for a family provision order “must be made not later than 12 months after the date of the death”. The Court can allow a late application if “sufficient cause” is shown, or if “the parties to the proceedings consent”.

Rectification of a Will

A rectification application must be made “within 12 months after the date of the death of the testator”. The Court can extend time if it “considers it necessary” and “the final distribution of the estate has not been made.”

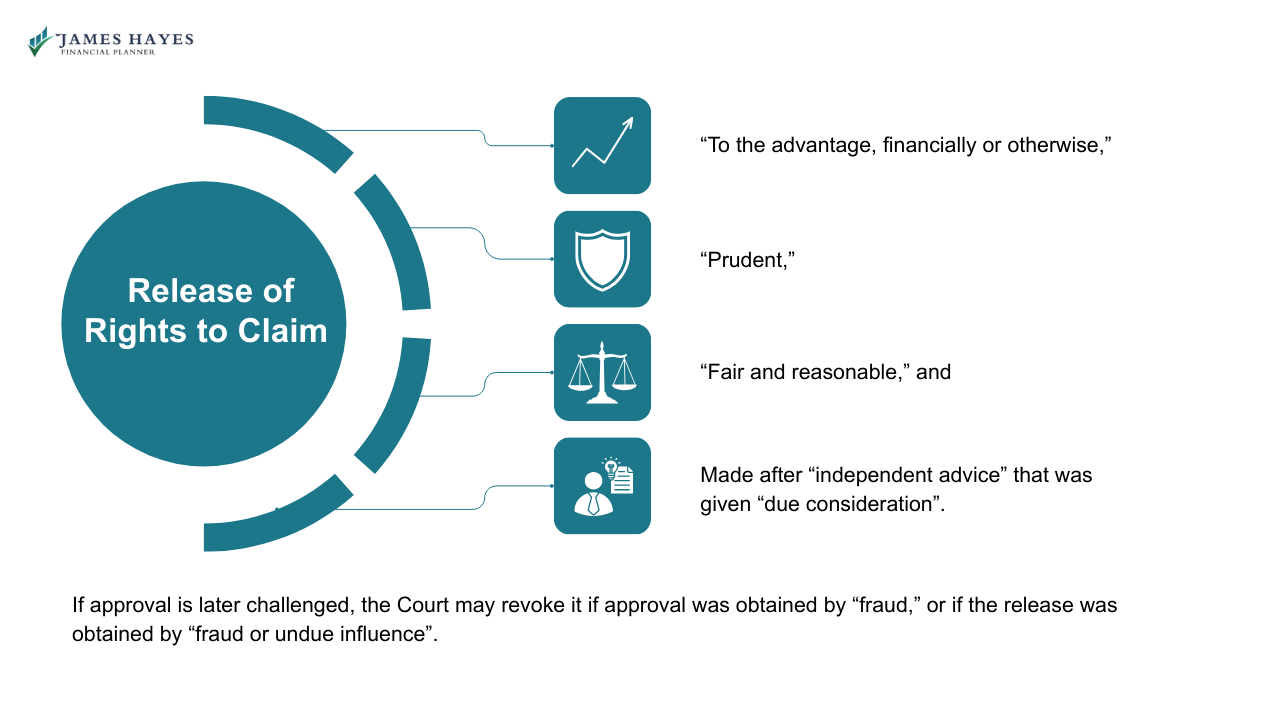

Release of Rights to Claim

Under the Family Provision Act 1982 (NSW), a person can sign a release agreeing not to apply for a family provision order against an estate. That release has effect only if the Court approves it, and only while that approval remains in place.

Applications for approval can be made before or after the death of the person whose estate may be affected, and the release can cover the whole estate or just a defined part (including notional estate). The Court considers the circumstances, including whether the release was, at the time of agreement:

“To the advantage, financially or otherwise,”

“Prudent,”

“Fair and reasonable,” and

Made after “independent advice” that was given “due consideration”.

If approval is later challenged, the Court may revoke it if approval was obtained by “fraud,” or if the release was obtained by “fraud or undue influence”.

Conclusion

Estate disputes in blended families usually start with uncertainty around who can claim, which assets belong inside the estate, and what superannuation trustees can decide. Clear records, early advice, and correct sequencing reduce delays and avoid avoidable tax and cash flow problems for beneficiaries.

If you are dealing with an estate, or planning for a blended family, James Hayes can help you model outcomes, plan for beneficiary cash flow, review how super nominations and ownership structures interact with your goals, and coordinate with your estate lawyer and accountant. Book a no-obligation 15-minute consultation for Sydney CBD or the Sutherland Shire.

FAQs

-

In NSW, an eligible person can include a spouse, de facto partner, child, former spouse, some dependants who lived in the household, certain grandchildren who were dependent, and a person in a close personal relationship. Eligibility is only the starting point. The Court still decides if provision was adequate.

-

Often, yes. In NSW, marriage can revoke a will unless an exception applies, such as a will made in contemplation of a particular marriage. Parts of a will that benefit the spouse, or appoint the spouse in key roles, can also be preserved. Review your will before marrying or remarrying.

-

Divorce or annulment usually removes gifts to a former spouse and cancels their appointment as executor, trustee, advisory trustee, or guardian, unless the will shows a contrary intention. The rest of the will can remain in place. If there are children from earlier relationships, check any trust arrangements and trustee appointments.

-

Often, yes. Under superannuation law, “child” can include step-children, so they may be eligible recipients if the trustee can pay them under the fund rules. Tax treatment is separate. For tax-free treatment as a “death benefits dependant”, a child is generally under 18, or otherwise financially dependent, or disabled.

-

Notional estate is property the NSW Court can treat as part of the estate for a family provision order, even if it is held outside the estate at death. It can apply where a relevant transaction shifted value away from the estate. It is commonly raised where the estate is too small to satisfy a claim.

-

In NSW, family provision claims and will rectification applications have strict time limits, commonly measured from the date of death. Extensions can be possible, but they are not automatic, and delay can reduce options, especially once the estate has been distributed. If you are considering a claim, get advice early.

Disclaimer

The information in this article is provided as a general guide only. It does not constitute personal financial advice and should not be relied upon as such. Readers should seek advice from a licensed financial adviser before making any financial decisions. James Hayes and his associated entities accept no responsibility or liability for any loss, damage, or action taken in reliance on the information contained in this article. Links to third-party websites are provided for reference purposes only. We do not endorse or guarantee the accuracy of their content.