Understanding Inheritance Tax in Australia

Summary

Australia does not impose a formal inheritance or estate tax. However, beneficiaries and estates may still face tax liabilities arising from capital gains tax, income tax, superannuation death benefits, and state-based duties. This article explains the legal framework, applicable taxes, and practical considerations for executors and beneficiaries.

Table of Contents

- Introduction

- Does Australia Have an Inheritance Tax?

- Historical Context of Death and Estate Taxes

- Taxes That May Apply When Assets Are Inherited

- Capital Gains Tax and Inherited Assets

- Superannuation Death Benefits and Tax Treatment

- Income Generated by Estate Assets

- State and Territory Considerations

- Executor Responsibilities and Compliance

- Common Misunderstandings

- FAQs

- Inheritance & Estate Planning Knowledge Bundle

Introduction

The term “inheritance tax” is commonly used but often misunderstood in the Australian context. While no direct inheritance tax exists, multiple tax rules can apply when assets transfer after death. Understanding these rules is essential for executors, beneficiaries, and advisors involved in estate planning and administration.

Does Australia Have an Inheritance Tax?

Australia does not levy a federal inheritance tax or estate tax. Beneficiaries are not taxed solely because they receive an inheritance. This position distinguishes Australia from jurisdictions that tax the transfer of wealth at death.

However, the absence of a formal inheritance tax does not eliminate all tax consequences. Other provisions within federal and state legislation may create tax obligations depending on asset type and beneficiary status.

Historical Context of Death and Estate Taxes

Australia previously imposed state-based death duties, which were abolished between 1977 and 1979. The removal followed concerns about complexity, inequity, and economic distortion. Since abolition, no replacement inheritance tax has been introduced at either the federal or state level.

Understanding this history helps explain why confusion persists, particularly among individuals familiar with overseas tax systems.

Taxes That May Apply When Assets Are Inherited

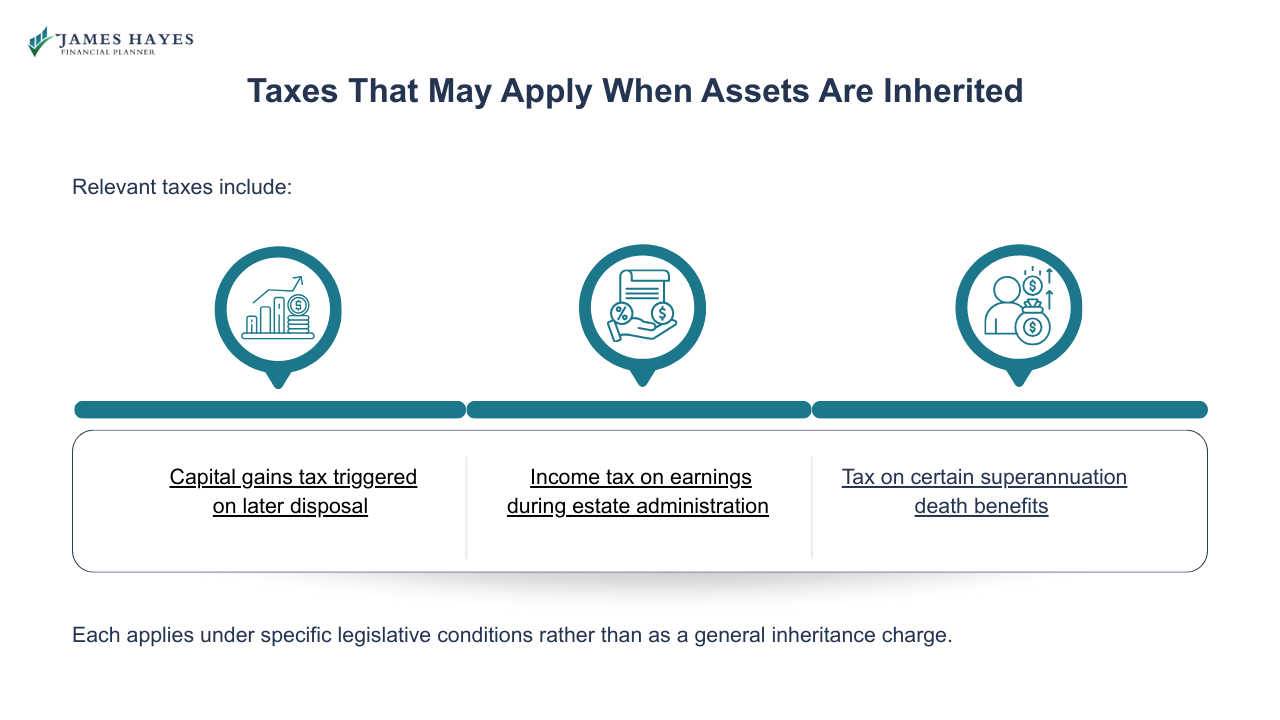

While the transfer itself is not taxed, several tax mechanisms can apply either to the estate or the beneficiary. These taxes depend on asset characteristics and timing rather than the act of inheritance.

Relevant taxes include:

Each applies under specific legislative conditions rather than as a general inheritance charge.

Capital Gains Tax and Inherited Assets

Capital gains tax (CGT) is governed by the Income Tax Assessment Act 1997. When an asset is inherited, CGT is generally deferred until the beneficiary disposes of the asset. The cost base depends on whether the asset was acquired before or after 20 September 1985.

The executor or beneficiary must maintain accurate records to calculate future CGT obligations.

Free eBook: Beneficiary Tax Records Checklist (Instant Download)

〰️

Free eBook: Beneficiary Tax Records Checklist (Instant Download) 〰️

Superannuation Death Benefits and Tax Treatment

Superannuation is not treated as part of the estate unless paid to the estate. Tax treatment depends on whether the recipient is a tax dependant under Australian tax law.

Tax dependants include spouses, minor children, and individuals in an interdependency relationship. Non-dependants may be taxed on the taxable component of the benefit under Income Tax Assessment Act 1997 provisions.

Income Generated by Estate Assets

During administration, estates may earn income from dividends, rent, or interest. This income is subject to taxation, and the estate is treated as a trust for tax purposes. Executors must lodge trust tax returns where required and allocate income correctly to beneficiaries. Failure to manage these obligations can result in penalties or delayed distributions.

State and Territory Considerations

Although inheritance tax does not exist, state and territory laws affect estate administration in the form of probate fees, land title transfer requirements, and stamp duty implications in limited circumstances. Each jurisdiction applies its own procedural rules, making local legal advice relevant when dealing with property or contested estates.

Executor Responsibilities and Compliance

Executors are responsible for administering the estate in accordance with the will and applicable law. They identify tax liabilities, lodge final tax returns, manage CGT records, and distribute assets appropriately. Executors may be personally liable for errors if taxes are not addressed before asset distribution.

Common Misunderstandings

A frequent misconception is that beneficiaries pay tax simply for receiving assets. Another misunderstanding involves superannuation, which follows separate rules from estate assets. Confusion also arises when comparing Australian law with international inheritance tax regimes. Clear differentiation between asset transfer and tax-triggering events is essential.

FAQs

-

No. Australia does not impose a federal or state inheritance tax. Beneficiaries are not taxed solely because they receive an inheritance. However, other taxes such as capital gains tax, income tax, or superannuation-related tax may apply.

-

No. Capital gains tax is deferred until the beneficiary disposes of the inherited asset. The cost base and exemption eligibility depend on when the deceased acquired the asset and how it is used after inheritance.

-

Superannuation death benefits are tax-free only when paid to tax dependants as defined by law. Payments to non-dependants may attract tax on the taxable component under federal income tax legislation.

-

An estate may pay income tax on earnings generated during administration. Executors may need to lodge trust tax returns and ensure income is distributed or taxed correctly before finalising the estate.

-

Yes, but only through legislative change at the federal or state level. Currently, no inheritance tax exists. Any future introduction would require formal legislation and would not apply retrospectively to completed estates.

Inheritance & Estate Planning Knowledge Bundle

Disclaimer

The information in this article is provided as a general guide only. It does not constitute personal financial advice and should not be relied upon as such. Readers should seek advice from a licensed financial adviser before making any financial decisions. James Hayes and his associated entities accept no responsibility or liability for any loss, damage, or action taken in reliance on the information contained in this article. Links to third-party websites are provided for reference purposes only. We do not endorse or guarantee the accuracy of their content.