The Importance of Financial Adviser Regulation and Licensing in Australia

ASIC licenses and supervises financial services. An AFSL is required to give financial product advice, and licensees must be efficient, honest, and fair. Individual advisers meet education, exam, Professional Year, CPD, and ethics standards. Verify AFSL and the Financial Adviser Register, read the FSG, and know your AFCA pathway.

Free eBook: Financial Adviser Selection Kit Click Me

〰️

Free eBook: Financial Adviser Selection Kit Click Me 〰️

Table of Contents

- Introduction

- Why Regulation Exists

- Role, Mandate, and Powers of ASIC

- What is an AFSL and Who Needs It?

- Own Licence vs Authorised Representative

- Professional Standards for Individual Advisers

- Terms to Know Before Verifying a Profile

- What Documents and Disclosures You Should Expect

- AFSL Obligations That Protect Clients

- Disputes and Remedies

- Unfair Contract Terms

- Current Focus Areas

- A Checklist Before You Book

- Work with James Hayes

- FAQs

- Financial Planner Knowledge Bundle

Introduction

If you are comparing financial planners in the Sutherland Shire or Sydney CBD, regulation should not feel like fine print. It is the framework that determines who is allowed to advise you, what they must disclose, how complaints are handled, and what recourse exists if something goes wrong. This guide explains the essentials of ASIC and AFSL, how advisers are authorised, and the checks you can run in five minutes before booking a meeting.

You can also download James’ NSW Financial Adviser Selection Kit for templates on defining scope, confirming authorisations, comparing fees in dollars, and scoring advisers side by side.

Why Regulation Exists

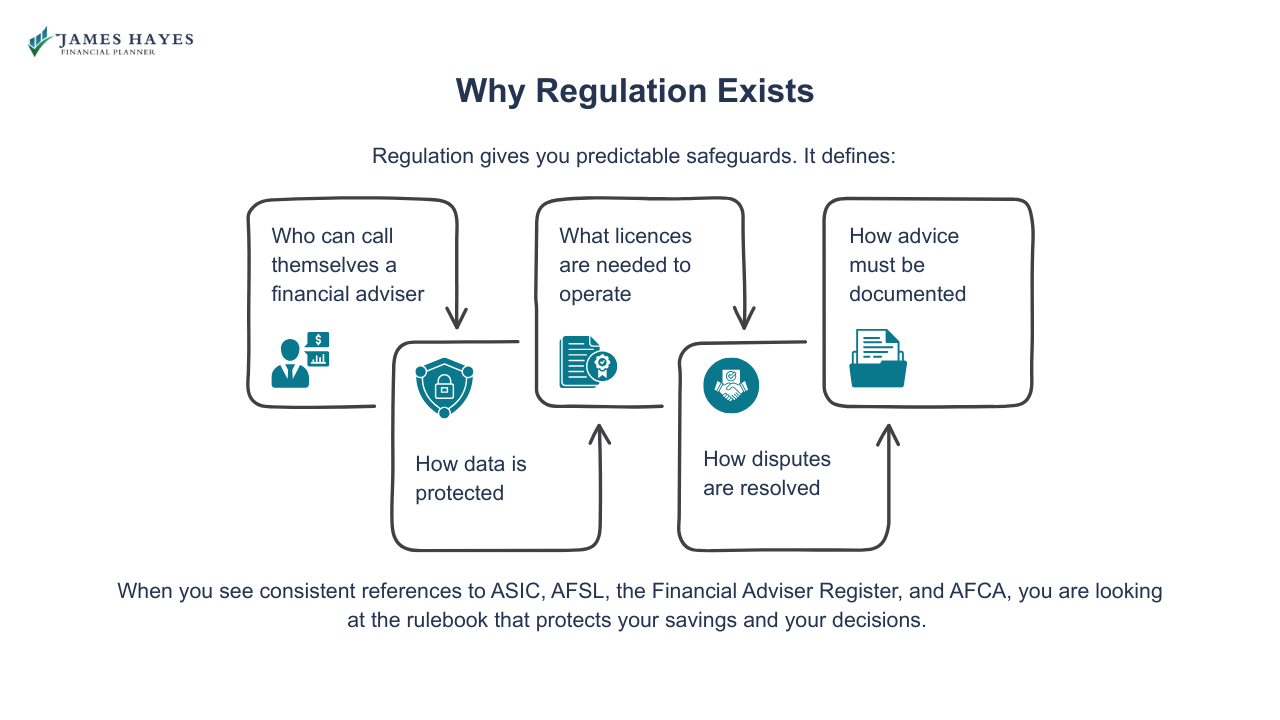

Regulation gives you predictable safeguards. It defines:

Who can call themselves a financial adviser

What licences are needed to operate

How advice must be documented

How data is protected

How disputes are resolved

When you see consistent references to ASIC, AFSL, the Financial Adviser Register, and AFCA, you are looking at the rulebook that protects your savings and your decisions.

Role, Mandate, and Powers of ASIC

The Australian Securities and Investments Commission (ASIC) is an independent Australian Government body that regulates companies, markets, financial services, and consumer credit.

Its mandate is to improve the performance of the financial system, promote confident and informed participation, administer the law efficiently, make information public, and enforce the law where needed. Its regulatory tools include licensing, rule-making, intervention, investigation, infringement notices, civil penalties, and banning powers. Its stated vision is a fair, strong, and efficient financial system for all Australians.

ASIC also publishes a Code of Conduct that binds its people to accountability, professionalism, and teamwork, and sets expectations around honesty, fairness, record-keeping, conflicts, and reporting wrongdoing. This underpins trust in how ASIC exercises its powers and interacts with the community.

What is an AFSL and Who Needs It?

An Australian Financial Services Licence (AFSL) is required if a business provides financial services such as:

Financial product advice

Dealing in financial products

Operating registered schemes

Providing custodial services

Making a market

Running a superannuation trustee service

Handling insurance claims

Operating a crowd-funding service

Some businesses operate under a limited AFSL if their scope is narrow. Holding or operating under an AFSL means the licensee must provide services efficiently, honestly, and fairly, meet financial and resource requirements, manage conflicts, have adequate risk management, and maintain internal and external dispute resolution, including AFCA membership.

For clients, the practical meaning is simple: the AFSL defines who is responsible for your advice, what standards apply, how the firm is supervised, and which compensation and complaint channels are available.

You can check ASIC registrations, AFSL details, fees, conflicts, and sample documents side-by-side with the NSW Financial Adviser Selection Kit. It gives you clear comparison tables you can complete in minutes.

Own Licence vs Authorised Representative

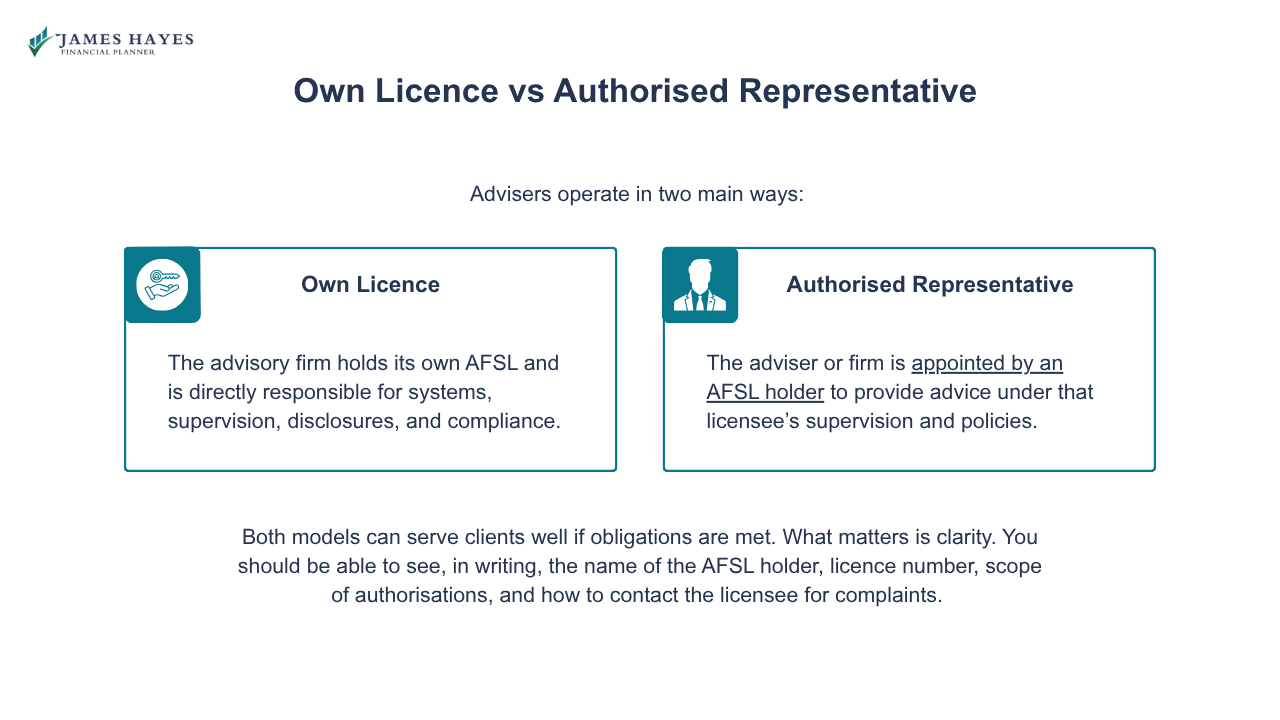

Advisers operate in two main ways:

AFSL holder: The advisory firm holds its own AFSL and is directly responsible for systems, supervision, disclosures, and compliance.

Authorised representative: The adviser or firm is appointed by an AFSL holder to provide advice under that licensee’s supervision and policies.

Both models can serve clients well if obligations are met. What matters is clarity. You should be able to see, in writing, the name of the AFSL holder, licence number, scope of authorisations, and how to contact the licensee for complaints.

Professional Standards for Individual Advisers

Beyond the AFSL, individual advisers who provide personal advice to retail clients must meet the legislated professional standards. These include:

An approved qualification pathway

Passing the financial adviser exam

Completing a Professional Year for new entrants

Meeting annual CPD requirements

Complying with the Financial Planners and Advisers Code of Ethics

ASIC implements and oversees these standards and maintains the Financial Adviser Register so consumers can verify an adviser’s status and authorisations.

Terms to Know Before Verifying a Profile

It helps to recognise a few terms used on the Financial Adviser Register and in licensee documents.

Relevant provider: An individual authorised to provide personal advice on relevant financial products to retail clients under an AFSL.

Provisional relevant provider: A new entrant in the Professional Year who is authorised in later quarters under supervision.

Experienced provider: A practitioner who met tenure and clean-record tests as at 31 December 2021.

Qualified tax relevant provider: An adviser who also meets tax-advice education requirements or is a registered tax agent.

These labels help you understand where an adviser is in their professional journey and what supervision or extra standards apply.

What Documents and Disclosures You Should Expect

A compliant practice provides plain-English documents at the right time:

Financial Services Guide (FSG): Explains who is advising you, AFSL details, fees and benefits, conflicts management, and dispute resolution pathways.

Statement of Advice (SoA): A record of personal advice, including your goals, recommended strategies and products, risks, fees, and alternatives.

Product Disclosure Statement (PDS): Sets out product features, benefits, risks, costs, and dispute processes.

Fee and consent forms: Disclose ongoing service fees and obtain written, annual consent where required.

Receiving these on time is both a compliance requirement and a practical way to stay informed.

AFSL Obligations That Protect Clients

Licensees must maintain adequate financial, technological, and human resources, supervise advisers, monitor training, manage conflicts, and keep risk management systems current. They must also belong to AFCA and operate internal dispute resolution under Regulatory Guide 271.

Some categories of licensees face enhanced financial requirements, and all licensees must notify ASIC of reportable situations and material changes. In short, there is a live compliance backbone behind every advice meeting you attend.

If you’re shortlisting more than one adviser, the NSW Financial Adviser Selection Kit gives you ready-made tables for AFSL checks, fee breakdowns, product shelf transparency, and a 100-point selection matrix.

Disputes and Remedies

If something goes wrong, you first use the firm’s internal dispute resolution. If unresolved, you can escalate to the Australian Financial Complaints Authority (AFCA), which is the free external dispute resolution scheme for financial services. ASIC oversees AFCA and can take enforcement action against misconduct, but ASIC does not provide individual compensation or personal legal advice. Knowing the two-step path in advance gives you confidence to act quickly if needed.

Regulation is easier to work with when it’s on one page. The NSW Financial Adviser Selection Kit turns ASIC, AFSL, AFCA, and fee rules into practical checklists and email templates you can use before you book.

Unfair Contract Terms

Courts can void unfair terms in standard-form consumer and small-business financial contracts. Since this law also extends to insurance contracts, it supports ASIC’s wider role of promoting trust, and ensures firms cannot rely on one-sided terms that disadvantage clients. If a term is voided, the rest of the contract can continue to operate without it.

Current Focus Areas

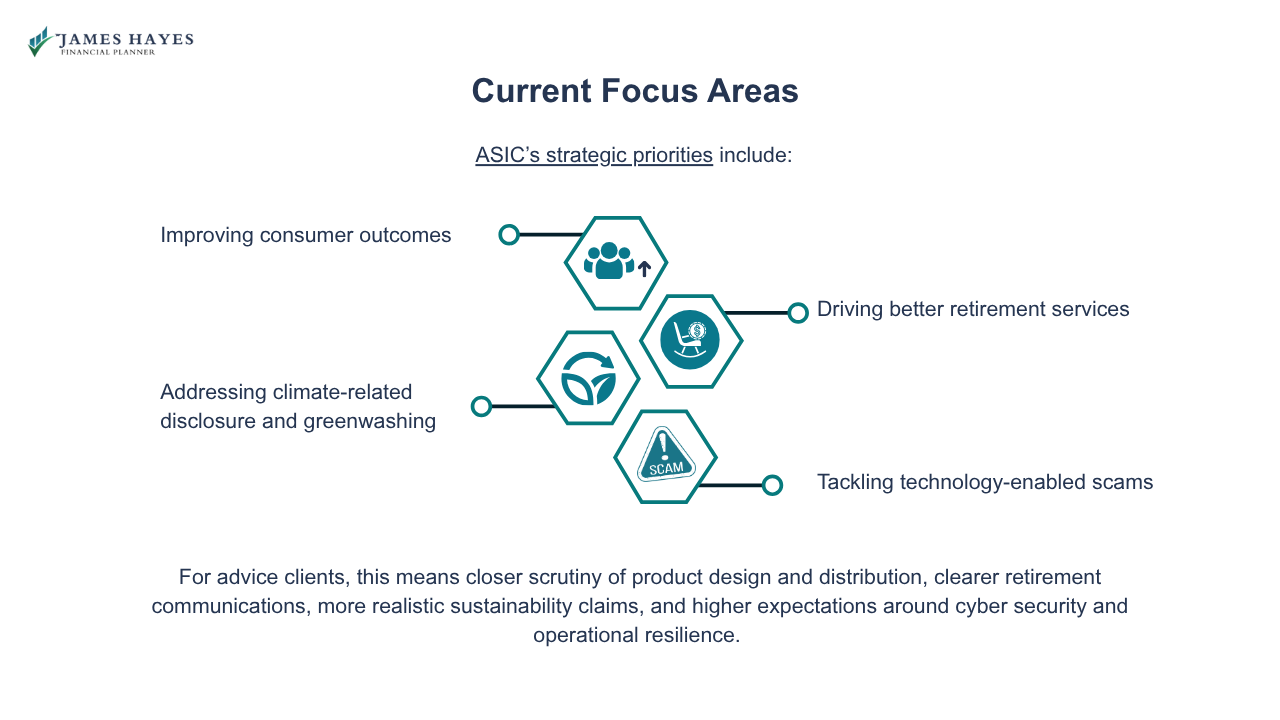

ASIC’s strategic priorities include:

Improving consumer outcomes

Driving better retirement services

Addressing climate-related disclosure and greenwashing

Tackling technology-enabled scams

For advice clients, this means closer scrutiny of product design and distribution, clearer retirement communications, more realistic sustainability claims, and higher expectations around cyber security and operational resilience.

A Checklist Before You Book

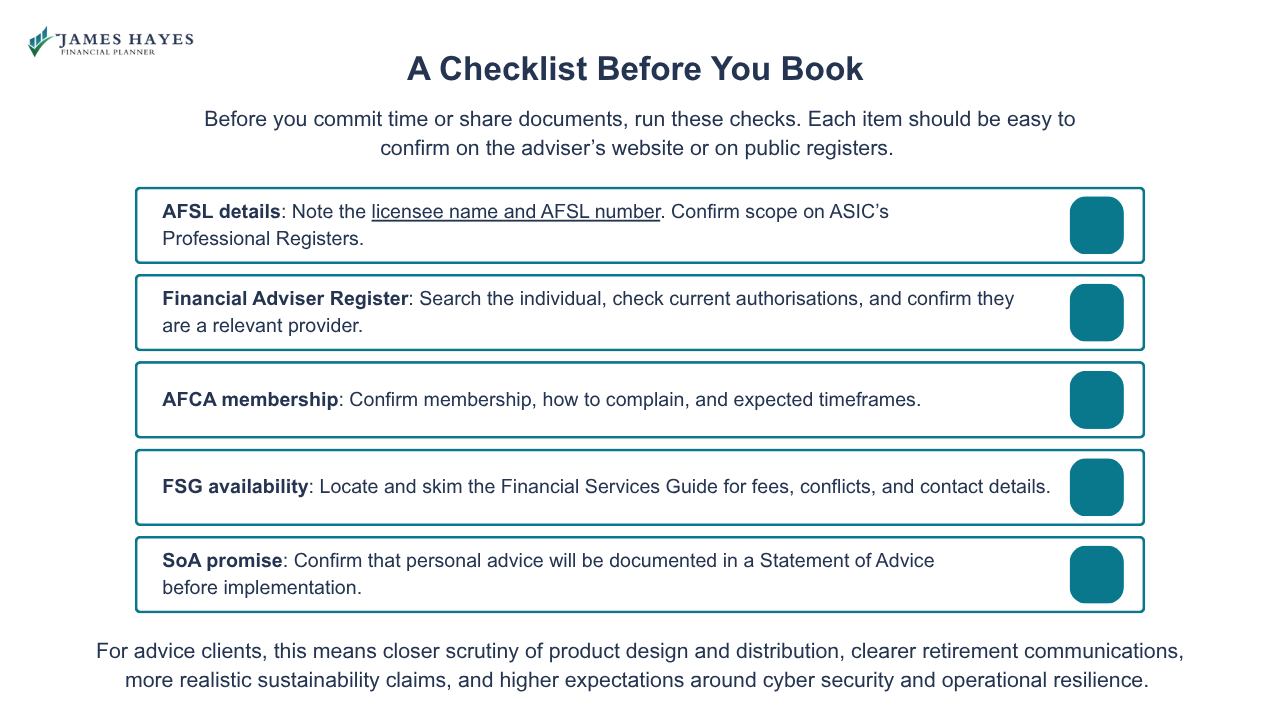

Before you commit time or share documents, run these checks. Each item should be easy to confirm on the adviser’s website or on public registers.

AFSL details: Note the licensee name and AFSL number. Confirm scope on ASIC’s Professional Registers.

Financial Adviser Register: Search the individual, check current authorisations, and confirm they are a relevant provider.

AFCA membership: Confirm membership, how to complain, and expected timeframes.

FSG availability: Locate and skim the Financial Services Guide for fees, conflicts, and contact details.

SoA promise: Confirm that personal advice will be documented in a Statement of Advice before implementation.

Cut through the guesswork. Download the NSW Financial Adviser Selection Kit for a detailed guide on scoping, verification, fee comparison, method assessment, and final decision, with space to document every response.

Work with James Hayes

James operates within Australia’s licensing and professional standards framework, provides written disclosures, and invites clients to verify credentials on public registers. Meetings include clear scope, fees in dollars, and formal advice documents. If a request sits outside scope, you will be told early and referred appropriately so time and expectations stay aligned.

Should you wish to engage James Hayes as your financial adviser, book a complimentary 15-minute call.

FAQs

-

Search the Financial Adviser Register for my name, then confirm the AFSL holder and authorisations match my Financial Services Guide. You can also check AFCA membership for dispute resolution. I will provide direct links and a current FSG so you can verify everything before we meet.

-

The AFSL holder is legally responsible for systems, supervision, disclosures, and dispute resolution. Knowing the licensee tells you who sets standards, who audits advice, and who to contact if something goes wrong. It also clarifies scope, so you know exactly what I am authorised to recommend.

-

You will receive an FSG first, followed by a Statement of Advice that sets out your goals, recommendations, fees, risks, and alternatives. Product Disclosure Statements accompany any product recommendations. Nothing proceeds until you understand and approve the documents, and we keep a dated record of decisions.

-

ASIC regulates the system and takes enforcement action where warranted, but it does not resolve individual complaints. You use my internal dispute process first, then escalate to AFCA if needed. That two-step pathway is a licence obligation, and I will guide you through it if issues arise.

Financial Planner Knowledge Bundle

- What Exactly Does a Financial Planner Do?

- Financial Advice vs Financial Planning

- Independent vs Institution-Linked Financial Advisers

- What Does Financial Advice Cost in NSW?

- How to Choose the Right Financial Adviser in Australia

- When to Get Financial Advice in Australia

- What Areas Do Financial Planners Cover?

- Online Financial Planning Services

- Financial Planning Process Explained

- Common Mistakes When Choosing Financial Advisers

- Certified Financial Planner (AFP®/CFP®) Explained

- Financial Adviser Regulation & Licensing (ASIC/AFSL) Explained

- Local Financial Planning Services in Sutherland Shire

Disclaimer

The information in this article is provided as a general guide only. It does not constitute personal financial advice and should not be relied upon as such. Readers should seek advice from a licensed financial adviser before making any financial decisions. James Hayes and his associated entities accept no responsibility or liability for any loss, damage, or action taken in reliance on the information contained in this article. Links to third-party websites are provided for reference purposes only. We do not endorse or guarantee the accuracy of their content.