How to Choose the Right Financial Adviser in Australia

Summary

Choose an adviser by defining your scope, verifying ASIC licensing and AFSL, confirming credentials (CFP/AFP), comparing all‑in fees in dollars, reviewing product shelf and conflicts, assessing investment method and review cadence, and testing communication fit. Shortlist three, request sample SoAs and a conflicts register, then select on evidence, avoiding claims.

Free eBook Financial Adviser Selection Kit (Instant Download)

〰️

Free eBook Financial Adviser Selection Kit (Instant Download) 〰️

Table of Contents

- Introduction

- Step 1 – Define Scope and Success Criteria

- Step 2 – Understand Adviser Models You Can Choose

- Step 3 – Confirm Licensing and Credentials

- Step 4 – Pricing and All-in Cost Comparison

- Step 5 – Investment Method You Can Understand and Evaluate

- Step 6 – Service Standards, Reporting, and Continuity

- Step 7 – Conflicts, Product Shelf, and Platform Ties

- Step 8 – Implementation, Custody, and Data Security

- Step 9 – Evidence That the Process Is Real

- Step 10 – Fit, Clarity, and Professional Conduct

- Step 11 – Selection Matrix You Can Score and File

- Step 12 – Request-for-proposal Email You Can Send Today

- Step 13 – Decision, Documentation, and Next Steps

- Conclusion

- FAQs

- Financial Planner Knowledge Bundle

Introduction

The adviser you select will shape how your superannuation, investments, insurance, and retirement income are designed and monitored. This guide sets out a disciplined process for choosing well: scoping your needs, verifying authorisations, comparing fees in dollars, assessing investment method, testing service standards, and recording everything in writing.

For complementary detail on timing and common pitfalls, see When to Get Financial Advice and Common Mistakes When Choosing a Financial Adviser. If you seek clarity on the role of a financial planner, see What Exactly Does a Financial Planner Do?

Step 1 – Define Scope and Success Criteria

Clarity at the start prevents wasted time and cost. Write down the outcomes you want, the topics you expect covered, and the deliverables you will require.

List your priorities before you speak to anyone. Typical inclusions: retirement income modelling, super contribution strategy, portfolio structure, insurance needs analysis, estate alignment, and review cadence. If you only need one issue solved, request a limited‑scope engagement.

To keep this practical, summarise your scope in one paragraph and a short bullet list you can send with quote requests.

Step 2 – Understand Adviser Models You Can Choose

In Australia, advisers sit under an Australian Financial Services Licence (AFSL) as licensees or authorised representatives. Business models differ in incentives and product access. For a deep dive on incentives, see Independent vs Institution‑Linked Financial Advisers.

Independent practices operate with client‑funded fees and broad product shelves. Institution‑linked practices operate with group platforms and an approved product list. Either model can deliver strong outcomes when incentives are disclosed and recommendations are documented.

Step 3 – Confirm Licensing and Credentials

What to verify?

Listed on ASIC’s Financial Adviser Register with current authorisations

AFSL details and complaint scheme membership (AFCA)

Qualifications and professional designations (e.g., CFP® or AFP®). See mine.

Eligibility to use the term independent under section 923A of the Corporations Act 2001 (Cth), with a written explanation if claimed

Record screenshots or PDFs of each check with the date.

Step 4 – Pricing and All‑in Cost Comparison

Price the engagement and the structure. Ask for fees in dollars and create a like‑for‑like comparison across candidates.

Fee Model Overview

Fixed project fees offer certainty for strategy and documentation. Ongoing service fees fund reviews and reporting. Hourly rates suit single‑issue work. Asset‑based fees scale with portfolio size. For a full NSW cost guide, scenarios, and a budgeting worksheet, see What Does Financial Advice Cost in NSW?

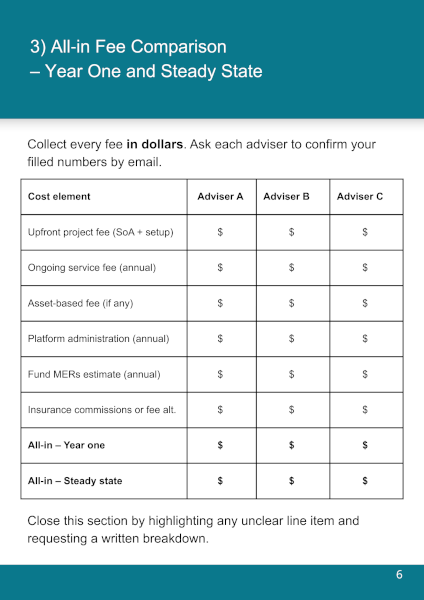

All‑in Comparison Table

Use this to gather figures in writing.

| Cost element | Adviser A | Adviser B | Adviser C |

|---|---|---|---|

| Upfront project fee (SoA + implementation) | $ | $ | $ |

| Ongoing service fee (annual) | $ | $ | $ |

| Asset-based fee (if any) | $ | $ | $ |

| Platform administration (annual) | $ | $ | $ |

| Fund MERs (annual, estimate) | $ | $ | $ |

| Insurance commissions or fee alternative | $ | $ | $ |

| All-in year one | $ | $ | $ |

| All-in steady state | $ | $ | $ |

After you fill the figures, ask each adviser to confirm the numbers by email.

Free Download Financial Adviser Selection Kit (Instant Download)

〰️

Free Download Financial Adviser Selection Kit (Instant Download) 〰️

Step 5 – Investment Method You Can Understand and Evaluate

An adviser’s investment method should be clear enough to repeat back in a few sentences. Request a concise summary and supporting evidence.

Good method disclosure includes:

Risk profiling approach and how it links to asset allocation ranges

Portfolio construction rules and rebalancing triggers

Research sources, product selection criteria, and cost controls

Governance – who proposes changes, who approves them, and how you consent

Ask for a sample portfolio for a client like you and a redacted one‑year review report.

Step 6 – Service Standards, Reporting, and Continuity

Advice value compounds when service is consistent. Define what you will receive across the year and who delivers it.

Service menu to confirm:

Meeting cadence and review agenda: Annual, half‑yearly, or quarterly.

Reporting pack contents: Performance, fees paid, portfolio changes, risk checks.

Execution: Who handles paperwork, how fast, and through which platform.

Contact model: Day‑to‑day contact, escalation path, and holiday cover.

Technology: Secure client portal, e‑signing, and document vault.

Record these commitments in your engagement letter.

Step 7 – Conflicts, Product Shelf, and Platform Ties

Incentives appear in the product shelf and remuneration. Test them with documents rather than conversation.

Documents to request:

Approved Product List and platform list

Conflicts register and remuneration summary

Written statement on any ownership links to platforms, funds, or insurers

Confirmation of any payments from issuers, in dollars

Compare how each adviser manages conflicts and how those controls appear in the Statement of Advice.

Step 8 – Implementation, Custody, and Data Security

Your assets and data should be held safely and administered by reputable providers. Clarify custody and execution before you sign.

What to confirm:

Platform or custodian name and service level

Where assets are registered and how cash is handled

Execution process and standard turnaround times

Professional indemnity insurance details

Privacy and cyber‑security measures for portals and email

Well‑documented operations reduce errors and delays when life events occur.

Step 9 – Evidence That the Process Is Real

Ask to see work products, not just promises. This is a simple way to separate a polished process from a sales routine.

Evidence pack:

Anonymised sample Statement of Advice that matches your scope

Redacted review report and action list

Example implementation timeline with milestones

References or case studies, where available and appropriate

Store these documents with your notes so you can compare like with like.

Step 10 – Fit, Clarity, and Professional Conduct

Expertise matters, and so does working style. Use the first meeting to judge clarity, listening, and responsiveness.

Fit checkpoints:

Clear explanations in plain English and readiness to model alternatives

Accurate restatement of your priorities without prompting

Time discipline and follow‑through on small requests

No pressure to commit before receiving written documents and time to review

These signals indicate how the relationship will feel at review time.

Step 11 – Selection Matrix You Can Score and File

A simple scoring matrix keeps decisions objective. Allocate weights that reflect your priorities, then score each adviser from 1 to 5.

| Criterion | Weight | Adviser A | Adviser B | Adviser C |

|---|---|---|---|---|

| Licensing & credentials verified | 15 | |||

| Incentive clarity & conflicts management | 15 | |||

| Investment method & documentation quality | 15 | |||

| Service standards & continuity | 15 | |||

| All-in cost in dollars | 15 | |||

| Scope fit & sample work quality | 15 | |||

| Communication fit | 10 | |||

| Weighted total | 100 | / | / | / |

Keep the completed matrix with email confirmations for your records.

Step 12 – Request‑for‑proposal Email You Can Send Today

A clean request helps advisers respond efficiently and gives you comparable quotes.

Template paragraph:

“Dear [Name], I’m seeking a written quote for financial advice. Scope includes [your topics]. Please provide: fees in dollars (upfront and ongoing), a one‑page all‑in year‑one and steady‑state cost, an anonymised sample Statement of Advice, your approved product list, and a conflicts register. Thank you.”

Use your own words, but keep the structure.

Step 13 – Decision, Documentation, and Next Steps

Once you choose, ask for a final engagement letter that lists scope, deliverables, and fees. You should also receive a Financial Services Guide. Only sign after you have had time to read and ask questions.

Conclusion

A thorough process removes guesswork. Define your scope, verify authorisations, compare all‑in costs, interrogate the method, and test service standards. Keep every answer in writing. If you live in the Sutherland Shire or Sydney CBD and prefer a local, relationship‑led approach, you can book a complimentary 15‑minute call with James Hayes to discuss scope and fit.

FAQs

-

You’ll get a cleaner comparison by interviewing three. Bring super and investment statements, insurance schedules, last tax return, household budget, and your priorities. Ask each adviser for a fixed‑fee quote, an anonymised sample Statement of Advice, their approved product list, and a conflicts register. Keep everything in writing for comparison.

-

Ask for all fees in dollars: upfront project, ongoing service, asset‑based fees, platform administration, fund MERs, and any insurance commissions. Request a one‑page all‑in cost for year one and a steady‑state year. Confirm how fees stop if service stops, and how annual consent and renewals are handled by the adviser.

-

Request a summary of their investment method – risk profiling, asset allocation ranges, rebalancing rules, and research sources. Ask for a sample portfolio for someone like you and a one‑year review report. Clarify who decides changes, how quickly changes occur, and how recommendations are documented for consent before any implementation.

-

Ask whether they are legally permitted to use the term independent under section 923A of the Corporations Act 2001 (Cth), and request a written explanation. Review their approved product list, platform ownership links, and conflicts register. Confirm payments received from issuers, in dollars. Compare answers across advisers and keep the documents with your file for reference.

-

Agree on meeting cadence, a review calendar, and turnaround times in writing. Confirm your day‑to‑day contact, escalation path, and who implements paperwork. Ask for a sample review pack, including performance, fees paid, portfolio changes, and next steps. Require secure portals and clear opt‑out terms for stopping ongoing services at any time.

Financial Planner Knowledge Bundle

- What Exactly Does a Financial Planner Do?

- Financial Advice vs Financial Planning

- Independent vs Institution-Linked Financial Advisers

- What Does Financial Advice Cost in NSW?

- How to Choose the Right Financial Adviser in Australia

- When to Get Financial Advice in Australia

- What Areas Do Financial Planners Cover?

- Online Financial Planning Services

- Financial Planning Process Explained

- Common Mistakes When Choosing Financial Advisers

- Certified Financial Planner (AFP®/CFP®) Explained

- Financial Adviser Regulation & Licensing (ASIC/AFSL) Explained

- Local Financial Planning Services in Sutherland Shire

Disclaimer

The information in this article is provided as a general guide only. It does not constitute personal financial advice and should not be relied upon as such. Readers should seek advice from a licensed financial adviser before making any financial decisions. James Hayes and his associated entities accept no responsibility or liability for any loss, damage, or action taken in reliance on the information contained in this article. Links to third-party websites are provided for reference purposes only. We do not endorse or guarantee the accuracy of their content.