Common Mistakes When Choosing a Financial Adviser

Summary

Avoid adviser selection mistakes by verifying licensing, getting fees in dollars, and confirming scope, cadence, and deliverables in writing. Probe conflicts and platform bias, demand projections with assumptions, and check data security. Ask about continuity, exclusions, and the first 90 days. Choose the adviser who proves process, not the one who makes grand promises.

Free eBook Red Flags When Choosing a Financial Adviser Guide (Instant Download)

〰️

Free eBook Red Flags When Choosing a Financial Adviser Guide (Instant Download) 〰️

Table of Contents

- Introduction

- What Does a Good Selection Process Look Like?

- Category 1: The Obvious Mistakes

- Category 2: The Less Obvious Mistakes

- Category 3: The Least Obvious Red Flags

- A Compact Pre-meeting Checklist You Can Use

- How James Hayes Addresses These Risks

- Conclusion

- FAQs

- Financial Planner Knowledge Bundle

Introduction

Finding the right adviser is often a long and arduous journey, which is worth it when you come under the guidance of a professional you can trust. Sadly, there have been several cases where hasty and uninformed decisions culminated in unpleasant experiences, including loss of money.

This guide walks through the mistakes people make most often, then moves into the subtler traps that appear only after you sign. Some sections include checks you can use before you book the first meeting.

What Does a Good Selection Process Look Like?

A sound process is simple: verify licensing and experience, confirm scope and fees in writing, review the service model and who does the work, and request a sample of deliverables. You want predictable steps, clear boundaries, and documented advice. Keep this frame in mind as you scan the mistakes below.

Before you proceed further, you might want to read How to Choose the Right Financial Adviser in Australia.

Category 1: The Obvious Mistakes

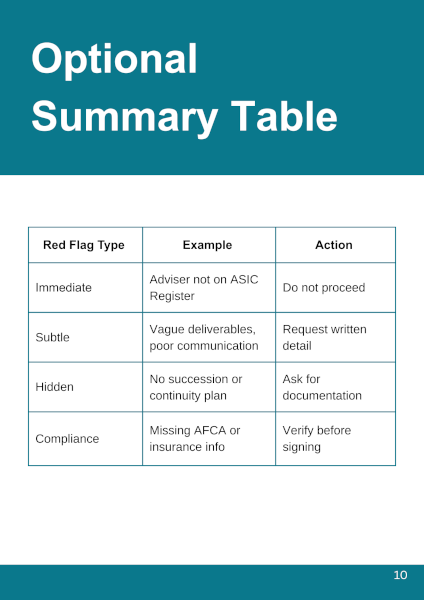

These are the red flags that are easy to check yet frequently overlooked. Take five minutes to clear them before you invest more time.

1) Not Verifying Licensing, AFSL, and Complaint History

Every individual adviser must be listed on the Financial Adviser Register, and they must advise under an Australian Financial Services Licence. Ask for AFCA details and check how complaints are handled. A professional will volunteer this upfront and invite you to verify it.

What to ask:

What is your AFSL, and where can I verify your authorisations?

Are you listed as an individual on the Financial Adviser Register?

If I have a complaint, what is the exact process and timeline?

2) Choosing Purely on Brand, Proximity, or Charisma

A well-known brand, a nearby office, or a great first chat is not evidence of capability. You are hiring a decision system. Ask for proof of process, not odes on personality, and make sure the adviser’s core work will help you with the decisions you need to make in the next 12–24 months.

3) Not Demanding Fee Clarity in Dollars

Fees should be stated in dollars, in writing, for both upfront work and ongoing service. Percentage-based statements can hide the real cost as your balances grow. Insist on a dollar schedule with inclusions, exclusions, and payment points.

| Fee type | How it works | Risks to watch |

|---|---|---|

| Fixed project fee | One-off for scoped advice and SoA | Scope creep if inclusions are vague |

| Ongoing retainer | Flat dollar fee for reviews and admin | Paying for services you do not use |

| Asset-based fee | % of assets, billed periodically | Costs can rise without extra work |

| Hourly rate | Pay per hour logged | Less predictability without a cap |

Read What Does Financial Advice Cost in NSW? for information on fees, models, examples, and how to budget.

4) Skipping a Written Scope Before the Statement of Advice

A written proposal should precede the SoA. It sets the scope, deliverables, and timelines so no one is guessing. If an adviser jumps straight to product talk or emails a document pack without a defined scope, slow down and recalibrate.

5) Accepting Vague Deliverables and No Timetable

You should know precisely what you will receive and when. Ask for meeting dates, modelling deliverables, and implementation checkpoints. If the adviser hesitates or handwaves timelines, expect delays later.

Free eBook Red Flags When Choosing a Financial Adviser (Instant Download)

〰️

Free eBook Red Flags When Choosing a Financial Adviser (Instant Download) 〰️

Category 2: The Less Obvious Mistakes

These issues rarely show up in the first conversation. They surface during implementation, when the market moves, or when your life changes and you need rapid, specific guidance.

6) Confusing a Portfolio Pitch with a Planning Process

Investments are a tool within a plan. If the first meeting fixates on tickers or platform features, you risk getting product selection without strategy sequencing. Ask how cashflow, super, insurance, estate documents, and tax settings will be coordinated and documented across a calendar.

7) Overlooking Who Does the Day-to-day Work

Many firms sell you on a principal, then hand you to juniors or a rotating pool. Continuity is important, especially at retirement. Ask to meet the person who will run your file, reply to your messages, and present the annual review.

What to verify:

Primary adviser and backup contact

Response expectations for email, phone, and WhatsApp

Who attends implementation calls and reviews

8) Ignoring Review Cadence and Event-driven Support

Annual reviews alone are not enough for pre-retirees, SMSFs, or clients with multiple entities. You need both a standard cadence and the ability to trigger short, event-based advice when something material changes.

Compare service models:

| Model | Good for | Watch for |

|---|---|---|

| Annual deep dive + interim check-ins | Established retirees, stable portfolios | Drifting priorities between reviews |

| Quarterly cadence | SMSFs, active accumulators | Cost vs value if little changes |

| Event-driven add-ons | Property moves, inheritances, TTR switches | Clear pricing for each event |

9) Not Probing Conflicts, Product Shelves, and Platform Bias

Ask how the adviser gets paid, what platforms they use, and whether they have quotas or restricted product lists. A clear conflict-of-interest statement and a plain-English explanation of why a platform was chosen should be standard.

Questions that surface bias:

How many platforms do you recommend, and why this one for me?

What alternatives did you reject, and on what criteria?

Do you receive any benefits from providers?

10) Accepting Projections Without Assumptions

A projection is only as good as its inputs. You should see wage growth, contribution rates, tax, fees, sequence-of-returns assumptions, and withdrawal rules. If a graph appears without a full input sheet, ask for it before you decide.

11) Neglecting Data Security and Document Controls

Financial files contain sensitive data. Confirm how documents are collected, stored, and shared. You want secure portals, e-signing with audit trails, and explicit controls for bank details and beneficiary nominations.

12) Underestimating the Value of a Meeting Record

Ask for meeting notes and action lists after every session. File notes protect you, help the adviser keep momentum, and reduce mistakes during implementation. They also make it easier to hand off tasks to your accountant or mortgage broker.

Free eBook Red Flags When Choosing a Financial Adviser (Instant Download)

〰️

Free eBook Red Flags When Choosing a Financial Adviser (Instant Download) 〰️

Category 3: The Least Obvious Red Flags

These are strategic blind spots. They do not always bite in year one, but they determine whether your plan holds up across a decade.

13) No Plan for Adviser Continuity and Succession

If your adviser is a sole operator, what happens if they step away for a period, or sell? If they are in a large corporate, how often do clients change hands? You need a written continuity plan with clear service standards.

14) Weak Change Management for Retirees and Near-retirees

Retirement is a period of rapid decisions: contribution timing, TTR toggles, pension commencements, and estate updates. Ask how the adviser sequences decisions across the financial year, and how deadlines are tracked to avoid irreversible mistakes.

Learn about the Financial Planning Process or get help deciding When to Get Financial Advice.

15) Poor Integration with Your Accountant, Broker, or Solicitor

Good advice is multidisciplinary. Confirm that your adviser is willing to speak with external professionals, share documents securely, and coordinate tax and estate implications before implementation.

16) No Evidence of First-hand Experience with Your Scenario

Look for case-style examples that mirror your situation: SMSF trustees in their 50s, couples retiring in the next year, or professionals juggling equity plans and property. Generic claims are easy. Specific, de-identified examples show experience.

17) Thin Governance Around Ethical Investing Requests

Ethical preferences require explicit filters, not a marketing label. Ask how screens are applied, how trade-offs are handled, and how ongoing monitoring works. You should see a written approach, not a one-line promise.

18) Missing Boundaries on Communication Channels

Fast communication is helpful, but boundaries reduce errors. If your adviser uses WhatsApp or SMS, ask how decisions are captured in the record, and how sensitive documents are handled. Informal channels should be mirrored in formal file notes.

19) No Clarity on What the Adviser Does Not Do

A professional draws lines. For example, some advisers like James Hayes do not lodge Centrelink forms or handle debt consolidation. Clarity on exclusions saves you time and avoids mismatched expectations.

20) Failing to Map the First 90 Days

The bedding-in period is where accounts move, contributions start, and providers change. Without a 90-day checklist and confirmations, tasks drift and delays compound. Ask for a milestone list with who does what, and when each step is considered complete.

A Compact Pre-meeting Checklist You Can Use

The list below is a quick tool to stress-test an adviser before you commit.

Licensing verified, AFSL listed, AFCA process provided

Written scope, fees in dollars, and timetable supplied

Service cadence defined, event-driven support priced

Conflicts disclosed, platform choice explained, alternatives shown

Projections delivered with full assumptions and inputs

Secure portal and e-signing confirmed, meeting notes provided

Continuity and escalation paths documented

Exclusions stated clearly, with referrals where relevant

Use this as a gate before the Statement of Advice is commissioned.

How James Hayes Addresses These Risks

James is independent of banks and large institutions, serves clients across the Sutherland Shire and Sydney CBD, and provides fees in dollars with clear inclusions. Meetings include whiteboard modelling, written notes, and a predictable review calendar. If a request falls outside scope, he says so early and offers alternatives.

Conclusion

Choosing an adviser is easier when you slow the process, test for proof over promises, and insist on written clarity. Check the obvious items, probe the less obvious frictions, and confirm the strategic safeguards. If each layer stands up, you have the foundations for a long, productive relationship. If you have a positive feeling about James Hayes, feel free to schedule a complimentary 15-minute introductory phone call with him.

FAQs

-

Search the Financial Adviser Register for the individual’s listing, confirm the AFSL, and ask for AFCA details. Request a one-page summary of scope, fees in dollars, and review cadence. If those arrive promptly and read clearly, book a discovery meeting and bring statements so we can test fit.

-

Ask each adviser to quote in dollars for the same scope and timeframe, with inclusions, exclusions, and payment points. Request a worked example using your balances. Percentage quotes can mask costs as assets grow. A clean dollar schedule is the simplest way to compare value, not just price.

-

Ask which platforms were considered, which were rejected, and why. Request the criteria, such as fees, functionality, custody, and reporting. If you only see one pre-selected option without alternatives, probe further. A good adviser explains the decision, the trade-offs, and how conflicts are managed.

-

You should see a dated list: account setup, transfers, contributions, insurance updates, beneficiary nominations, and confirmations. Expect secure document exchange, e-signing where possible, and written status updates. At day 90, you receive a summary of what is live, what is pending, and next review dates.

Financial Planner Knowledge Bundle

- What Exactly Does a Financial Planner Do?

- Financial Advice vs Financial Planning

- Independent vs Institution-Linked Financial Advisers

- What Does Financial Advice Cost in NSW?

- How to Choose the Right Financial Adviser in Australia

- When to Get Financial Advice in Australia

- What Areas Do Financial Planners Cover?

- Online Financial Planning Services

- Financial Planning Process Explained

- Common Mistakes When Choosing Financial Advisers

- Certified Financial Planner (AFP®/CFP®) Explained

- Financial Adviser Regulation & Licensing (ASIC/AFSL) Explained

- Local Financial Planning Services in Sutherland Shire

Disclaimer

The information in this article is provided as a general guide only. It does not constitute personal financial advice and should not be relied upon as such. Readers should seek advice from a licensed financial adviser before making any financial decisions. James Hayes and his associated entities accept no responsibility or liability for any loss, damage, or action taken in reliance on the information contained in this article. Links to third-party websites are provided for reference purposes only. We do not endorse or guarantee the accuracy of their content.