Financial Planner vs Financial Adviser – What’s The Difference?

Summary

Yes, the words overlap in Australia. In practice, “financial planning” describes the ongoing process and service relationship, while “financial advice” refers to the regulated recommendations documented in a Statement of Advice, delivered by a licensed financial adviser listed on ASIC’s register, with fees and conflicts disclosed in writing, before engagement.

Table of Contents

- Introduction

- Are “Financial Planning” and “Financial Advice” Different Things?

- “Financial Planner” vs “Financial Adviser” – Is There a Legal Difference?

- Planning vs Advice vs The Professional You Hire

- Qualifications, Licensing, and Ethics

- What Each Looks Like in Real Life

- Do You Need Financial Planning or Just Financial Advice?

- Independent vs Institution-linked Entities

- Pricing

- Scope Boundaries

- A Simple Due-diligence Checklist Before You Choose

- Where James Hayes Fits

- FAQs

- Financial Planner Knowledge Bundle

Introduction

Australians often use the words financial planning and financial advice interchangeably, and they’ll call the professional a financial planner or financial adviser. In practice, the regulatory line sits with advice, while planning refers to the broader process and relationship that wraps around those recommendations. The role is licensed, documented, and overseen by ASIC, regardless of the job title printed on a business card.

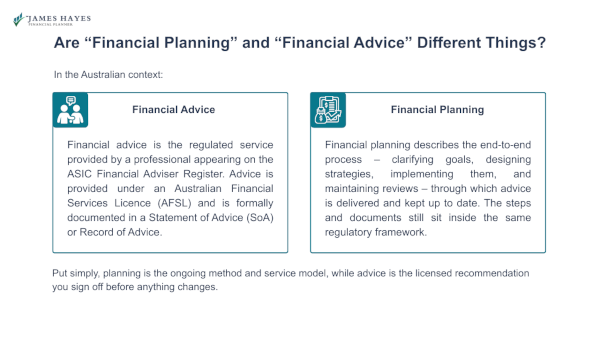

Are “Financial Planning” and “Financial Advice” Different Things?

In the Australian context:

Financial advice is the regulated service provided by a professional appearing on the ASIC Financial Adviser Register. Advice is provided under an Australian Financial Services Licence (AFSL) and is formally documented in a Statement of Advice (SoA) or Record of Advice.

Financial planning describes the end‑to‑end process – clarifying goals, designing strategies, implementing them, and maintaining reviews – through which advice is delivered and kept up to date. The steps and documents still sit inside the same regulatory framework.

Put simply, planning is the ongoing method and service model, while advice is the licensed recommendation you sign off before anything changes.

“Financial Planner” vs “Financial Adviser” – Is There a Legal Difference?

Across websites and conversations, these titles are used interchangeably. What matters in law is whether the person is authorised to give financial product advice and operates under an AFSL with current registrations. You can confirm this on the ASIC Financial Adviser Register, and you should see complaint coverage via AFCA.

One title that does carry a strict legal test is “independent”. Under the Corporations Act 2001 (Cth), an adviser may use independent, impartial, or unbiased only if they meet specific conditions – no commissions or volume‑based payments, no issuer ties, and no conflicts that could influence advice. Always ask for written confirmation and check the register.

Planning vs Advice vs The Professional You Hire

The table below summarises how the concepts relate in practice.

| Item | What it means in Australia | Documents you receive | Who provides it | How to verify |

|---|---|---|---|---|

| Financial advice | Regulated recommendations you approve before implementation | Statement of Advice, Records of Advice, fee disclosures, consent renewals | A licensed professional (planner/adviser) under an AFSL | ASIC Financial Adviser Register, AFCA membership |

| Financial planning | The ongoing process – scoping, modelling, implementation, and reviews | SoA plus a service calendar, review packs, and change records | The same licensed professional, through an agreed service model | Engagement letter and documented service standards |

| Financial planner / adviser | Common titles for the same licensed role | Credentials and authorisations, fee and conflict disclosures | Individual or firm, independent or institution-linked | FAR listing, AFSL details, conflicts register, APL |

Qualifications, Licensing, and Ethics

Modern reforms reshaped the profession:

FOFA removed conflicted remuneration.

FASEA/education standards lifted qualifications and ethics.

DDO strengthened product design and distribution oversight.

Advisers must appear on the FAR, operate under an AFSL, and deliver advice through compliant documents.

Many add recognised designations such as AFP® and CFP®. See James’ AFP® credentials.

What you can check quickly:

Before you engage anyone, verify the following and keep screenshots with dates:

FAR listing with current authorisations and AFSL details

AFCA membership

Qualifications and any professional designations

Written statement explaining any use of the term independent under s923A of the Corporations Act 2001 (Cth).

These checks are routine, simple, and protect you from unlicensed operators.

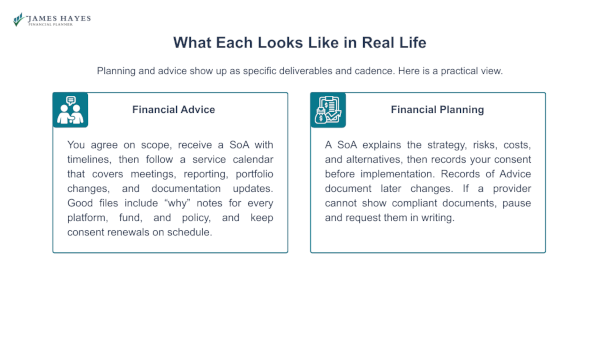

What Each Looks Like in Real Life

Planning and advice show up as specific deliverables and cadence. Here is a practical view.

Financial Planning

You agree on scope, receive a SoA with timelines, then follow a service calendar that covers meetings, reporting, portfolio changes, and documentation updates. Good files include “why” notes for every platform, fund, and policy, and keep consent renewals on schedule.

Financial Advice

A SoA explains the strategy, risks, costs, and alternatives, then records your consent before implementation. Records of Advice document later changes. If a provider cannot show compliant documents, pause and request them in writing.

Do You Need Financial Planning or Financial Advice?

Your needs steer the right engagement shape. The tiers below (illustrative) reflect how Australians often buy advice.

| Situation | Engagement shape | Typical inclusions |

|---|---|---|

| One decision to make now (e.g., contributions, portfolio update) | Limited-scope advice | Short Record of Advice, implementation steps |

| Several connected topics, clear timeline | Targeted project | SoA across 2–3 topics, staged implementation |

| Retirement, inheritance, or SMSF complexity | Full plan | Modelling, portfolio, insurance review, estate alignment, service calendar |

These tiers mirror common fee patterns in NSW and help you buy only what you need today.

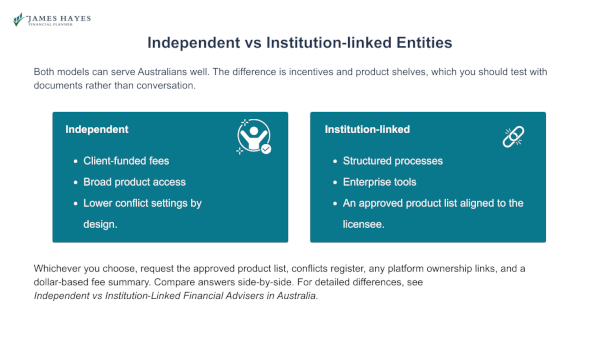

Independent vs Institution‑linked Entities

Both models can serve Australians well. The difference is incentives and product shelves, which you should test with documents rather than conversation.

Independent: Client‑funded fees, broad product access, lower conflict settings by design.

Institution‑linked: Structured processes, enterprise tools, and an approved product list aligned to the licensee.

Whichever you choose, request the approved product list, conflicts register, any platform ownership links, and a dollar‑based fee summary. Compare answers side‑by‑side. For detailed differences, see Independent vs Institution‑Linked Financial Advisers in Australia.

Pricing

In NSW, fees vary with scope and service model. Common approaches include fixed project fees for SoAs, ongoing retainers for reviews, hourly fees for one‑off issues, and percentage‑based fees for portfolio administration. Life‑insurance commissions still exist within caps and must be disclosed in dollars.

If a quote feels low or vague, ask for the all‑in view – advice fees, platform fees, fund MERs, and any commissions. Keep the figures in writing.

Learn more about the price of financial advice in What Does Financial Advice Cost in NSW?

Scope Boundaries

Professional planning spans superannuation, retirement income, investments, insurance, and estate alignment, with referrals to your accountant or solicitor where needed. Many firms, including James Hayes, do not manage Centrelink applications or early‑access‑to‑super requests, and will signpost you to Services Australia or a specialist instead.

Check out What Areas Do Financial Planners Cover? The Full Financial Service Menu for a breakdown of James Hayes’ offerings.

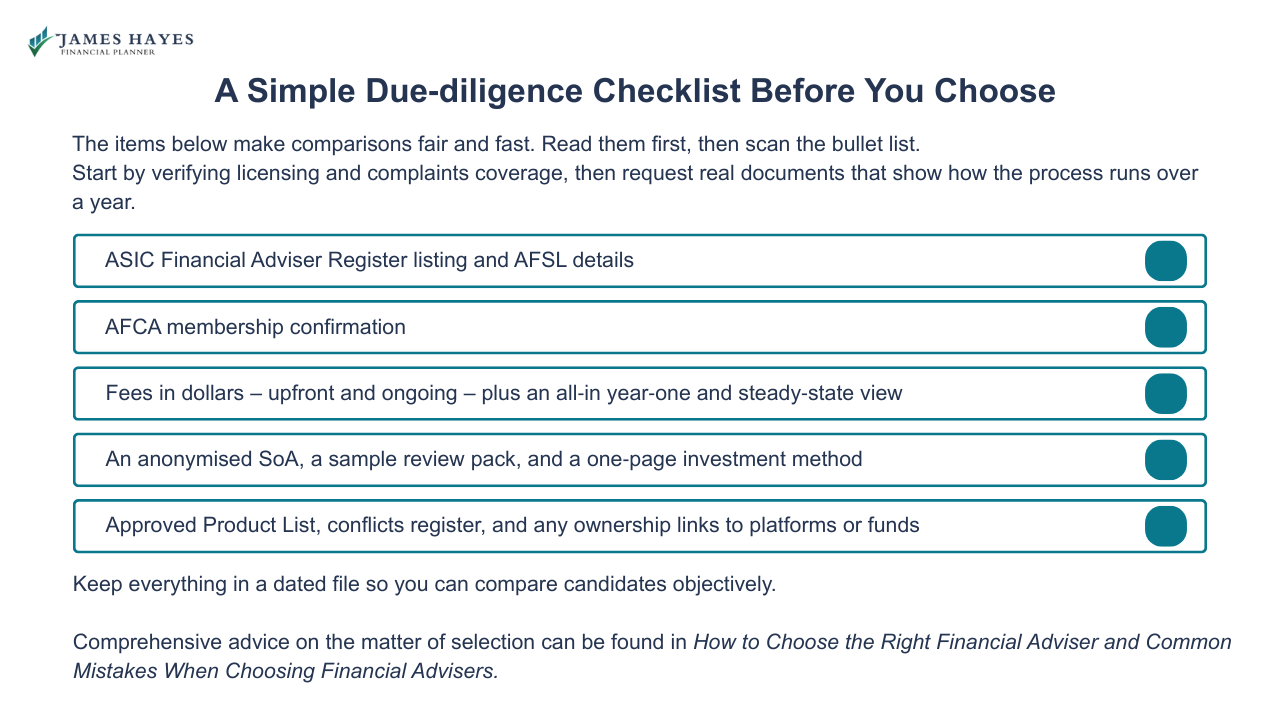

A Simple Due‑diligence Checklist Before You Choose

The items below make comparisons fair and fast. Read them first, then scan the bullet list.

Start by verifying licensing and complaints coverage, then request real documents that show how the process runs over a year.

ASIC Financial Adviser Register listing and AFSL details

AFCA membership confirmation

Fees in dollars – upfront and ongoing – plus an all‑in year‑one and steady‑state view

An anonymised SoA, a sample review pack, and a one‑page investment method

Approved Product List, conflicts register, and any ownership links to platforms or funds

Keep everything in a dated file so you can compare candidates objectively.

Comprehensive advice on the matter of selection can be found in How to Choose the Right Financial Adviser and Common Mistakes When Choosing Financial Advisers.

Where James Hayes Fits

James operates as a non‑bank‑aligned adviser serving the Sutherland Shire and Sydney CBD. He focuses on retirement planning, super and SMSFs, ETF portfolios, property strategy, inheritance, aged care planning, and estate alignment.

Start with a triage call, then a longer whiteboard session if there is a fit. Typical upfront fees when proceeding range from $2,200 to $6,600, depending on scope.

Ready to confirm what you need and in what scope? Book your complimentary15‑minute triage call. If James can help, you will see a written proposal with fees in dollars, clear deliverables, and a service calendar before you commit.

FAQs

-

In Australia, the regulatory line sits with financial product advice, not job titles. Both “financial planner” and “financial adviser” commonly describe the same licensed role that provides Statements of Advice under an AFSL. The word “independent” is restricted by law, so verify authorisations and ties on ASIC’s register, in writing.

-

Use financial planning when several parts connect, including super, investments, insurance, and retirement income, and you want an ongoing review calendar. Choose limited‑scope financial advice for one decision, such as contributions or portfolio structure. Either way, expect a Statement of Advice, fee disclosure in dollars, and scheduled reviews, before implementation.

-

Check the ASIC Financial Adviser Register for current authorisations, AFSL details, and any history. Confirm AFCA membership. Ask for fees in dollars, an anonymised Statement of Advice, a review pack, an approved product list, and a conflicts register. Keep every answer in writing and compare responses side‑by‑side before engaging someone.

-

Independence is valuable, yet not mandatory. The Corporations Act 2001 (Cth) restricts the word “independent,” so ask any adviser to explain their status in writing, and verify on ASIC’s register. Compare breadth of the product shelf, conflict controls, fees in dollars, and sample documents. Choose the combination that fits your goals and preferences.

-

I start with a complimentary 15‑minute triage call. If advice proceeds, typical upfront fees range from $2,200 to $6,600, depending on scope. You receive a Statement of Advice, implementation support, a review calendar, and reporting. Every figure appears in dollars, and I explain inclusions before you commit, in plain English.

Financial Planner Knowledge Bundle

- What Exactly Does a Financial Planner Do?

- Financial Advice vs Financial Planning

- Independent vs Institution-Linked Financial Advisers

- What Does Financial Advice Cost in NSW?

- How to Choose the Right Financial Adviser in Australia

- When to Get Financial Advice in Australia

- What Areas Do Financial Planners Cover?

- Online Financial Planning Services

- Financial Planning Process Explained

- Common Mistakes When Choosing Financial Advisers

- Certified Financial Planner (AFP®/CFP®) Explained

- Financial Adviser Regulation & Licensing (ASIC/AFSL) Explained

- Local Financial Planning Services in Sutherland Shire

Disclaimer

The information in this article is provided as a general guide only. It does not constitute personal financial advice and should not be relied upon as such. Readers should seek advice from a licensed financial adviser before making any financial decisions. James Hayes and his associated entities accept no responsibility or liability for any loss, damage, or action taken in reliance on the information contained in this article. Links to third-party websites are provided for reference purposes only. We do not endorse or guarantee the accuracy of their content.