Free eBook

This planner helps you understand your 2025–26 super contribution options, how they affect your tax, and which contribution types make sense for your income—so you can walk into a meeting with a clear draft plan, not a blank page.

This guide helps you with:

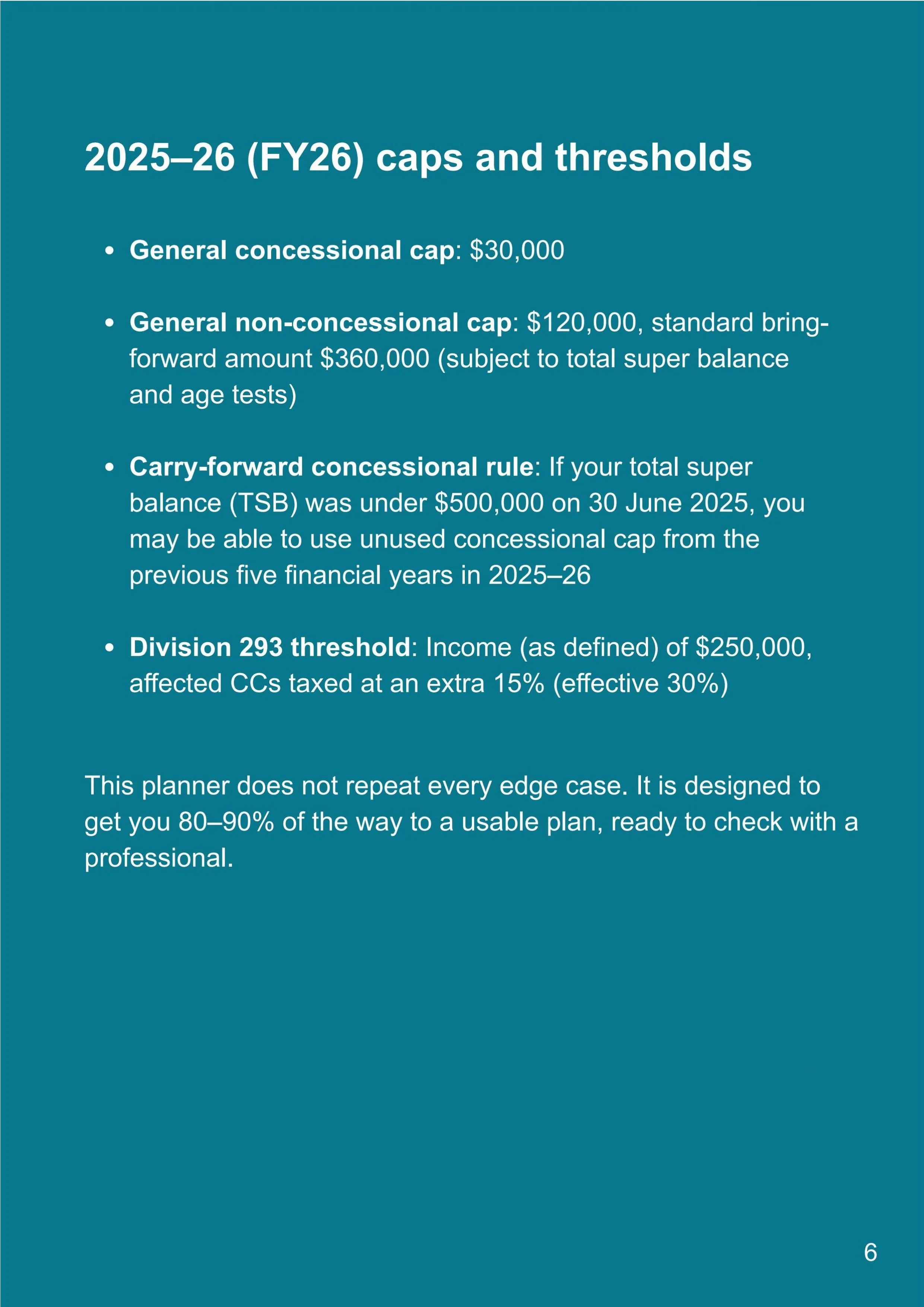

Understanding the key 2025–26 super rules, caps, and thresholds

Clarifying different contribution types and when each applies

Mapping your current income, age, and super position

Choosing a concessional contribution strategy that fits your income level

Planning non-concessional and spouse contribution strategies

Identifying potential issues before 30 June 2026