Free eBook

Inherited property can trigger capital gains tax depending on use, timing, and who sells. This tool helps you avoid costly mistakes by clarifying dates, occupancy history, and valuations so you can confirm the likely CGT outcome before selling, renting, transferring, or renovating.

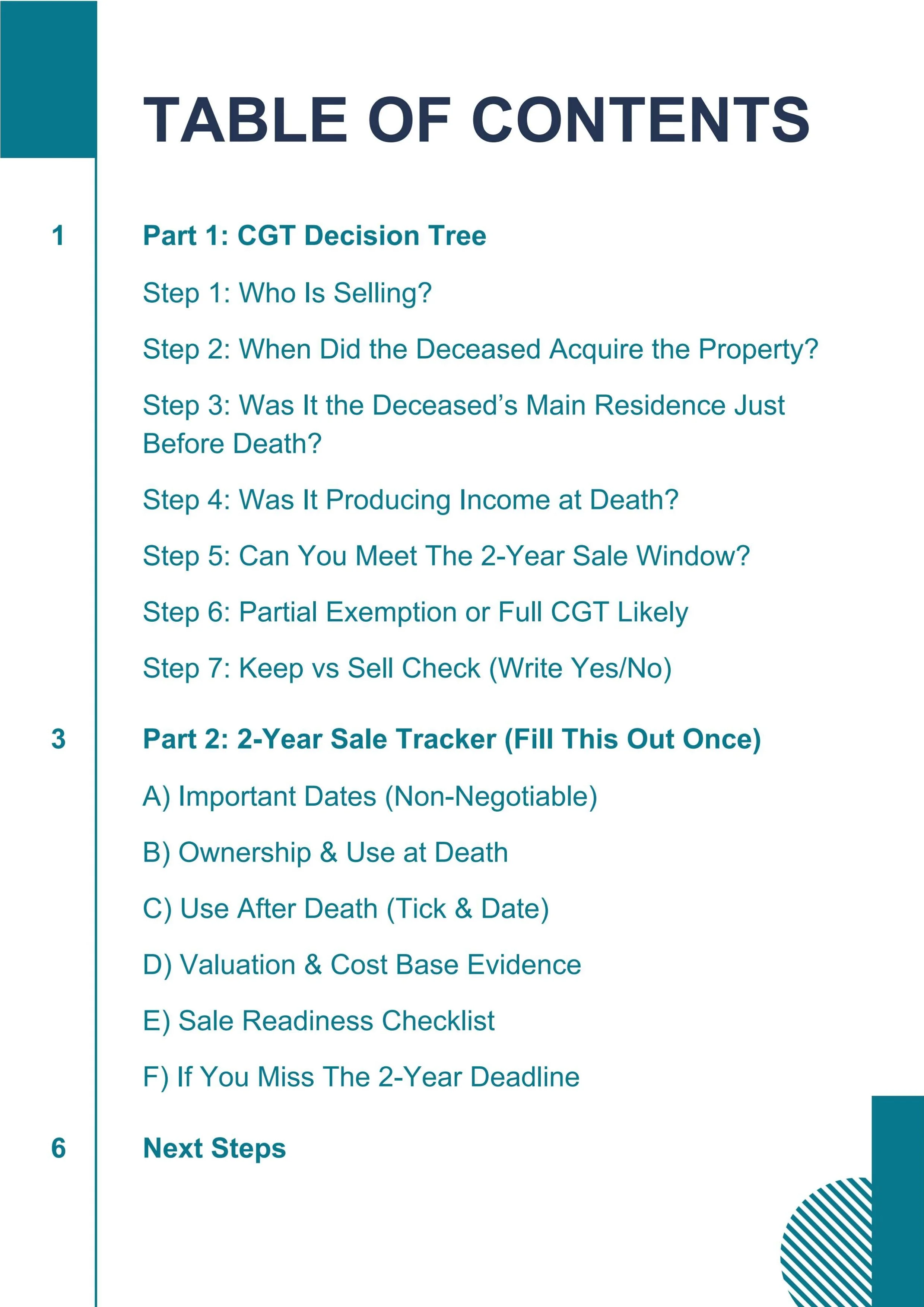

This guide helps you with:

Determining the likely CGT outcome using a clear, step-by-step decision tree

Identifying how ownership, main-residence status, and income use affect CGT

Tracking the critical 2-year sale window and other non-negotiable dates

Recording use, ownership, and valuation evidence needed for CGT calculations

Deciding whether to keep or sell the property and preparing for sale if required